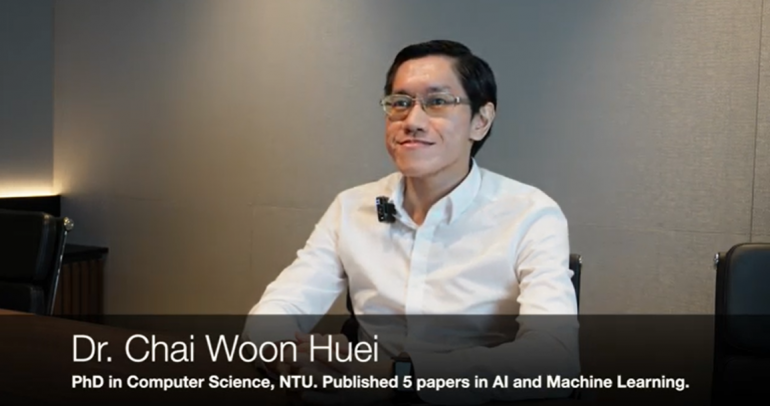

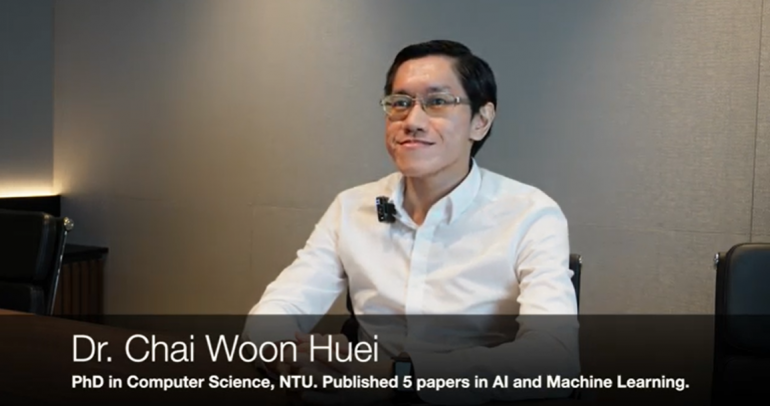

The Aggregate Series is a new series of interviews featuring the fund management team and staff of Aggregate Asset Management. This series kicks off by featuring Dr Chai Woon Huei, our data scientist and quantitative researcher.

Important: Scam Alert! Caution of Impersonation / Telegram and/or Whatsapp Scams. Learn More >

The Aggregate Series is a new series of interviews featuring the fund management team and staff of Aggregate Asset Management. This series kicks off by featuring Dr Chai Woon Huei, our data scientist and quantitative researcher.

Presently, we use AI as a stock screener to add value to our decision-making process. Join us in this AI discovery journey and may the best portfolio — man vs machine; concentrated vs diversified, win.

Aggregate Asset Management has unlocked the formula on how best to use machine learning in picking winning stocks. The success of AI applications in finance and investments will be discovered in this article.

Our Chairman, Kishore Mahbubani, shared his views on “What will be the Key Growth Drivers over the next 2 Years”

Throughout history, people have tried to invent one – a machine that can actually be in motion forever, without the aid of additional energy. The truth is, it is not possible as it violates all the laws of thermodynamics. However, what is impossible in the world of science, is possible in the world of finance.

Aggregate Asset Management’s investment philosophy is reflected in its name — Aggregate. Its funds such as the Aggregate Value Fund and the Aggregate Global Equities Fund are aggregations of many stocks. Based on AAM’s proprietary machine learning outcomes, the funds invest in the top 1% of stocks in the investing universe.

By Kishore Mahbubani, speaking as Chairman of Aggregate Asset Management, at Managing Global Uncertainties; Seizing Global Opportunities, a webinar jointly held with The Edge Singapore on 9 July 2022.

Inflation and potential famine appear to be the flow-throughs to the global economy from the Russia-Ukraine War. What are the likely geopolitical and economic shifts once the fog of war lifts? Also, find out important ways to fortify portfolios, including the feedback from Machine Learning on equities.

Meet Gilbert, a man of many talents, a quirky sense of humour, and an uncommon sense of optimism. Quite unexpected for a wheelchair-using individual, you would think.

“Rule of 72” is a simplified way to determine how long an investment will take to double, given a fixed annual rate of interest. By dividing 72 by the annual rate of return, investors can get a rough estimate of how many years it will take for the initial investment to double.