“Questioning is not the mode of conversation among gentle people.”

Samuel Johnson

What do you invest in?

We invest in listed equities (stocks) globally, with a focus on Asia. If we are not fully invested, we hold cash.

Isn’t investing in stocks risky?

Yes it is.

To succeed in stocks, one must invest with a time horizon of at least 5 years. We do not think it is possible to do well in investing by trading and timing the market. This only makes your broker rich. Only invest money you can put away for 5 years.

To succeed in stocks, one must invest with a time horizon of at least 5 years. We do not think it is possible to do well in investing by trading and timing the market. This only makes your broker rich. Only invest money you can put away for 5 years.

Is this a good time to invest?

It is always a good time to invest, provided that the markets are not sky-high. The markets are not sky-high today – so it is a good time. When it is not a good time to invest – we will stop subscription to the fund.

What about Ukraine War, US Fed raising interest rates, China potential debt crisis, COVID, Klingons, oil price spikes, tech stocks price corrections, cryptocurrency meltdown, regional instabilities and global logistical challenges etc….?

We are not experts in such matters and cannot forecast what will happen. A wise man once said, “Forecasts may tell you a great deal about the forecaster; they tell you nothing about the future”. We agree. We concentrate on buying good businesses. When there is nothing of value to buy, we stop, or we sell.

What kind of reports do I get?

You will get a monthly report from Crowe Horwath the fund administrator. The monthly report will show you the total amount of your investment in terms of the number of units and the NAV per share. The fund managers will provide a quarterly update. They might give their views on the economy and where it is heading (usually wrong) – and tell you a bit on the stocks that they have purchased (usually right).

Is there a risk where you can run away with my money?

Not at all.

Your money and your stocks will be in a pool of funds under the care of DBS Custody. We do not handle your money or your stocks – we just issue instructions to buy/sell. The fund auditor is Ernst and Young – it audits the fund to make sure that everything is fit and proper. Reporting and valuation is done by Crowe Horwath, an international accounting and auditing firm. They make sure all subscriptions/redemptions and computation of NAVs, number of shares and performance fees are done accurately.

Also, we are regulated by the Monetary Authority of Singapore. We fear them and wouldn’t want to mess with them.

Is this a scam?

Absolutely not! However, there is an ongoing scam happening, and real people have been scammed – refer here.

How do you manage currency risk?

We do not use overlays or hedge currency risks. We are not experts in currencies. Hedging here, there, everywhere only makes your banker rich, and subtracts from performance over the long term. Our portfolio of stocks across Asia with businesses in different countries earning different currencies provides somewhat of a hedge – but not completely though. We can live with that.

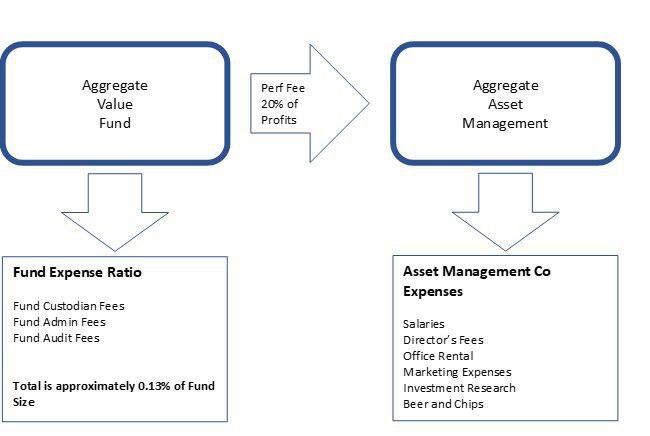

What do you mean by interest alignment? What is this zero management fee model?

We believe that we should only be rewarded when our clients make money. We also believe that we can add value for our clients over the long term. That is why we have come up with the 0% management fee. For all the other products out there, the charges are: Sales charge of 3-5%, Management Fee of 1-2% p.a. and if your account is under a wrap account, there is a wrap fee of 1% p.a. Is there any surprise that most of the products out there are not meeting your expectations?

How do I subscribe?

Don’t just subscribe – we like to talk to you first. We expect our investors to know what they are doing – and we do not mind spending time and effort in telling you what we do and explaining to you what you are in for.

What is the worst thing that can happen?

Not investing. And timing the market. And flitting from opportunity to opportunity. And wasting precious time which can be used to invest, reap dividends, and watch the NAV grow.

How is the NAV of the fund determined?

The NAV for the fund is determined by Crowe Horwath – they are an independent accounting and fund administration firm.

Who can invest in the fund?

The fund is only for accredited investors. Accredited investors mean individuals with a net asset of SGD$2M or an annual income of $300,000. For companies, they need at least a net asset of SGD$10M.

Is there any lock-in period for my investment?

Yes. We expect you to keep your money there for at least 3 years. If you redeem before the 3 years is up, you have to pay an exit fee of 5%. Please only invest money you do not need. After 3 years, all redemptions have no exit charges.

How can I use this fund for my retirement?

Generally, you can make a withdrawal of 5% of the initial subscription for your retirement needs. For example, for every $1M you have invested, you can make a yearly redemption of $50,000. There is no redemption charge. This is ideal for clients who want an income, and yet have a need to beat inflation.

Can I make subsequent subscriptions in the fund?

Yes. The secret to really making serious money over the long term: Subscribe whenever you have spare cash. Subsequent subscriptions are pegged at a minimum of $10,000 and do not carry any charges. The FULL amount is put to work – there are no bloodsuckers at Aggregate Asset Management leeching out your precious blood.

Will I lose all my money?

No, not all – but you might lose 50% of it, momentarily. Stay out of stocks if you cannot accept that. In the past 3 big crises (2008, 2020, 2022), all stocks were annihilated. So if you were to meet with a market crisis (surely it will happen again) – sit tight – do not sell and if possible, invest some more. It will recover, barring a global thermonuclear war.

How do you compute the performance fee? And what is this High Water Mark?

Aggregate Value Fund does not charge annual management fees or sales charges. We only charge a performance fee of 20% on profit based on a high water mark. Let’s assume that you invest at $100 and after some time its value increases to $110. The performance fee is $2 (profit of S$10 x 20%). The net value is $108 after deducting the performance fee of $2. This $108 is a high water mark, as profit is made, and performance fee is taken. Later it goes down to $97. There will be no performance fee, since it’s a loss. Subsequently it rises to $105. There will be no performance fee, since it has not exceeded its high water mark set earlier at $108. Further on, the value rises from $105 to $118. There is a new profit of $10. This is computed by taking the new value $118 minus the old high water mark $108. A performance fee of $2 is charged (20% * $10). Now, the new high water mark is $116. This high water mark mechanism demands that the fund managers earn an absolute profit for the clients before they are rewarded.

What is this $2000 subscription charge? I thought you say no other fees, only performance fees?

The $2000 charge is a one-time flat charge for new clients. You do not need to pay any more for further top-ups. In contrast, there is a 2-5% sales charge that most financial service providers levy on the amount invested or top-up. Whether you invest $200,000 or $2M, our charge is flat at $2000. So why the $2000? This is to cover our admin fee, documentation and subsidize a small part of our audit and compliance fee.

What is equalisation credit and contingent redemption?

Grab a coffee and read this and this. We also have an article from Crowe Howarth about Equalisation Accounting. To find out more about it, click here!