Recently, Aggregate Asset Management, in partnership with The Edge Singapore, held an engaging webinar – ‘Managing Global Uncertainties; Seizing Global Opportunities’. In one of the topics discussed, Moderator Goola Warden asked a compelling question,’ What has machine learning got to do with it?’. Our Head of Special Projects, Harry Huo, enlightened her. This article is a summary of the sharing.

What’s machine learning got to do with it?

We have all heard the term ‘Machine Learning’ being bandied about in almost every articles.

From medicine to marketing, from environment to education, from sports to science.

But what exactly is it? And what can it do?

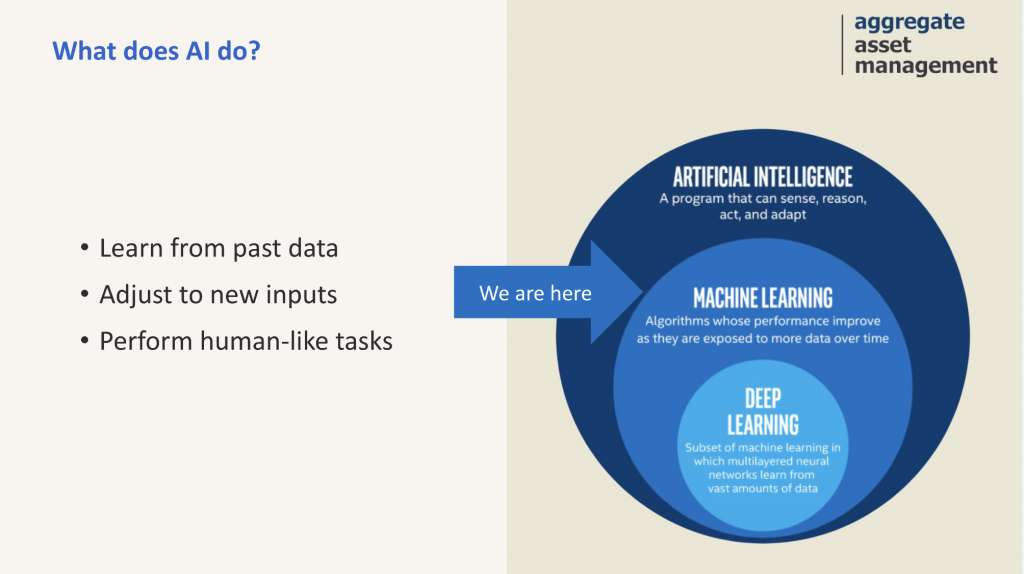

For starters, let us demystify machine learning, because when we think about AI, ala artificial intelligence, machine learning is a subset of it.

While we may think it belongs to the fantastical world of data scientists, programmers and hackers, it is in actual fact, something quite simple.

Anyone who spends a little bit of time on the subject will be able to grasp the fundamentals of machine learning.

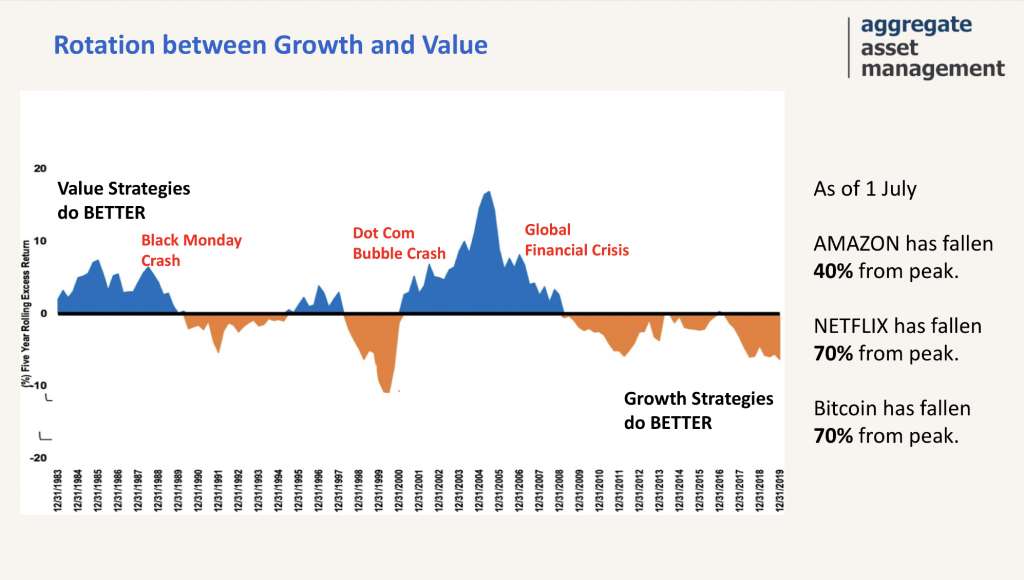

But first, understand that markets function between growth and value stocks.

There are periods when value strategies will do well, and there are times when growth strategies will do better.

You will realise, there is a rotation between the two.

However, over the last 10 years, markets have been going through a growth strategy period – probably due to the tech boom.

Many will advise you to buy tech stocks, like Facebook, Alibaba, Amazon, and Netflix. Chances are, if you do, you are going to do pretty well.

However, the question right now is, “Are we reverting back to the bearing phase?”

As of July this year, Amazon has fallen 40% off the peak, Netflix is 70% down, while Bitcoin which is perhaps a representative of the excesses of the tech boom, is down by 70%.

So that gives you a perspective of why markets will always rotate between the two sets of stocks – growth and value.

Is there a way to pick winning stocks regardless of the rotation?

For those who have been with AAM, you will know we started off as a very strong tenant of value stocks.

However, in these current times, do we have to wait long, before the value period rises again?

Can’t we have the best of both worlds, where both value and growth stocks do well in the portfolio?

There is a way, but we are limited by the limitations of human beings.

A typical stock analyst will look at 10 to15 financial ratio indicators before he makes his stock selection.

The truth is, human beings cannot handle too many variables.

The famous Fama and French academic paper – about investing in small cap stocks and a low price to book ratio – says that is only two variables.

What if there were 50 variables? It is almost impossible for a human being to comprehend, let alone manage them!

But let us challenge ourselves – is it possible to add the sum of all things, throw in everything, including the kitchen sink, into our analytical model?

Can we achieve a favourable outcome? Well, it’s too difficult to predict.

So, the answer is, we need machine learning to help us achieve success.

Not because our methodology is wrong, but because we need machine learning to handle the many variables.

In truth, AI is really good, for a couple of things.

AI is able to learn from past input, before adjusting to new inputs, and they perform human-like tasks – more efficiently and quicker.

AI is also good at classification. Consider this scenario, where you ask your child, “Tell me the difference between a cat and a dog?”

To make sure he knows, you show him pictures, take him to the zoo, to the pet store, and so on. In no time, your child will be able to tell the difference.

The AI, on the other hand, is not so clever. It needs tons and tons of sample data to train it, to gain the ability to differentiate between the cat and the dog. But once it gets it, The AI gets it very fast.

Currently, the technology is about 97% accurate, if you use AI.

And this is something we are already doing, using AI classification in many areas.

Think of Facebook, which is about pattern recognition – it knows who your friends are, who your family is, who you want to show off to?

Then you have Amazon, which is actually pattern recognition of your purchasing pattern.

While Tesla is known for road recognition.

Ultimately, pattern recognition is still about classification, which is what AI is all about and very good at.

But what is the success of AI applications in finance and investments?

Well, here’s a shocking statistic for you, from Forbes – 85% of all AI projects have been known to fail in the real world.

Whatever you use right now, whatever that works right now, is the rare 15%.

And if you’re talking about specialised areas like finance and investment, it’s probably 5% or 10% percent.

So, it’s a rare breed indeed.

If one is still considering AI, it is important to use a checklist, where you have to ask these questions:

• Has the AI been trained?

• What is the size of the data set?

• Did you test it for 1 month or for 1 year?

• How rigorous was the testing, and what was the outcome?

There must be a positive outcome that can help you, if not AI is pointless.

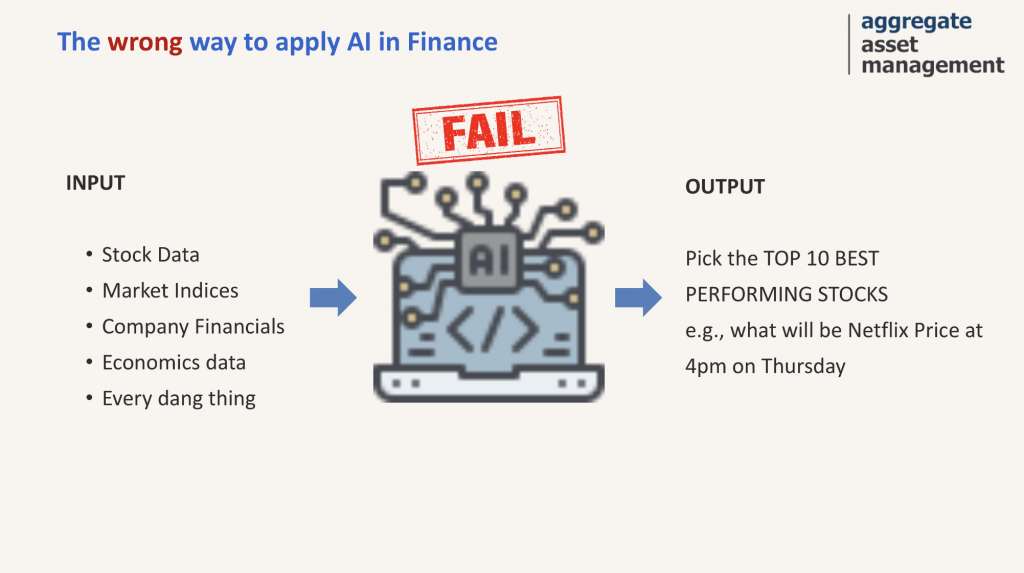

Some may think, to apply AI in finance and investment, you just have to plonk in stock market data, market indices, company financials and macroeconomic indicators, into this magic machine, and the output allows you to pick the top 10 performing stocks.

If that’s the perception, then it is completely wrong, as you’re asking AI to do more than it can right now.

Let’s look at it in another way – take for example, there are three stocks before you – Hershey, Duke Energy and Netflix.

Let’s look at Netflix first, with an operating income growth of 90%, it’s obviously a good stock , but currently, it is not doing too well.

Maybe it’s time to look at Hershey or Duke Energy, since the PE is low?

But how do you choose? As human beings, we can’t decide quickly, and you want the AI to do this for you?

If you look at Netflix, over the last 2 years, it was the darling of analysts, because during Covid, people were stuck at home, so they watched lots of shows.

Even after the pandemic stabilised, and we returned to our offices and schools, we continued subscribing to the service.

But lately we’ve come to realise, good content is hard to produce. There are only so many shows like Queen’s Gambit or Umbrella Academy.

Right now, we have run out of things to watch and everyone has sort of fallen out of love with Netflix, hence the huge drop in share price.

So what’s the problem here? Well, put the blame on noise.

There’s too much noise in financial data, the statistical speed is very low signal to noise ratio.

But to the layman, he will just call it too much noise in financial data, hence it is very hard to apply AI to finance and investment.

So, is that the end, is there no better way?

Fortunately, there is. And AAM has unlocked the formula on how best to use machine learning in picking winning stocks.

To discover how we apply machine learning in investing, check out our detailed explanation in a previous article on the subject. Just click on the link below to gain a deeper understanding and explore your options. Better still, contact us and request an appointment. We look forward to guiding you in becoming an investing success.

Watch the video of ”What’s machine learning got to do with it?” here: