We want to bring your attention to reports of unauthorized individuals or entities that have been impersonating as personnel of Aggregate Asset Management Pte Ltd (“AAM”) via Telegram and WhatsApp, and inviting people to join group chats.

Important: Scam Alert! Caution of Impersonation / Telegram and/or Whatsapp Scams. Learn More >

We want to bring your attention to reports of unauthorized individuals or entities that have been impersonating as personnel of Aggregate Asset Management Pte Ltd (“AAM”) via Telegram and WhatsApp, and inviting people to join group chats.

AVF has demonstrated a remarkable Compound Annual Growth Rate (CAGR) of approximately 12.01% over a 3-year period from April 2020 to April 2023. The 40.84% growth rate of AVF over the past three years also outperforms the AC Asia Pacific by 31.17%.

The recent failure of Silicon Valley Bank (SVB) has sparked discussions about the importance of diversifying our retirement portfolios. SVB had been a key player in providing finance and services to technology startups for many years but its collapse due to heavy investment in treasury bonds has highlighted the risks of not diversifying investments.

Aggregate Asset Management’s investment philosophy is reflected in its name — Aggregate. Its funds such as the Aggregate Value Fund and the Aggregate Global Equities Fund are aggregations of many stocks. Based on AAM’s proprietary machine learning outcomes, the funds invest in the top 1% of stocks in the investing universe.

Inflation and potential famine appear to be the flow-throughs to the global economy from the Russia-Ukraine War. What are the likely geopolitical and economic shifts once the fog of war lifts? Also, find out important ways to fortify portfolios, including the feedback from Machine Learning on equities.

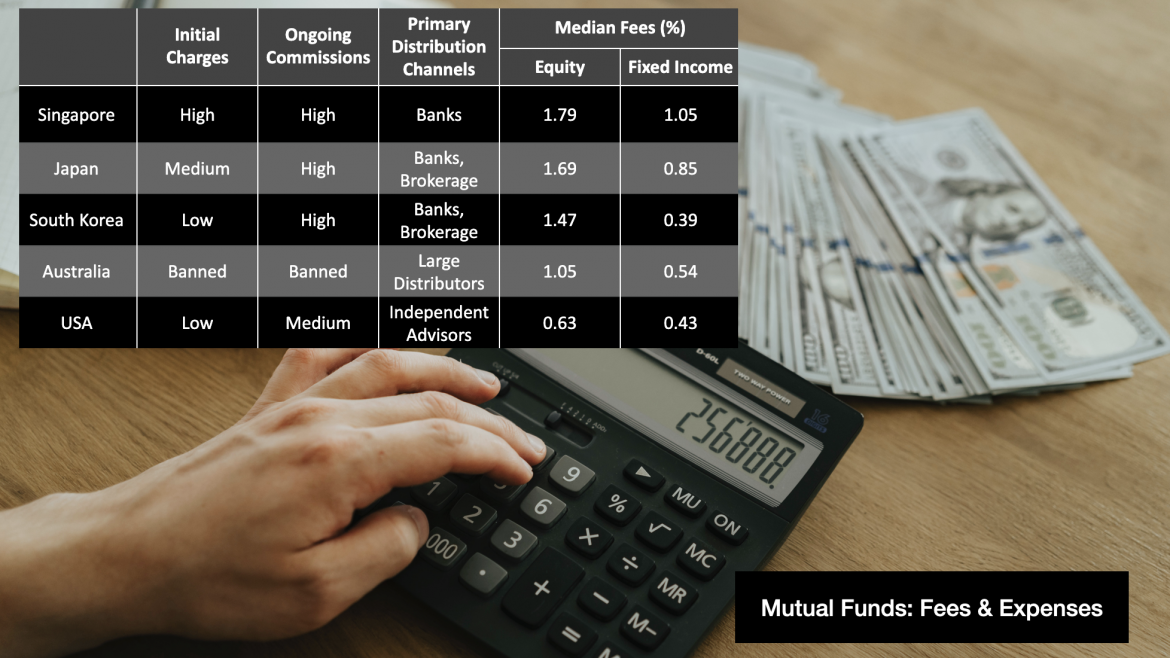

The Fees and Expenses grade for Singapore remains Below Average, according to a recent report by MorningStar. Unlike most other funds in Singapore, Aggregate Asset Management adopts the zero management fee model.

Aggregate Asset Management became the first company to be listed on the private securities exchange, 1exchange (“1X”).

Rising interest rate, trade tariff implementations, uncertain geopolitical risk. The stock markets have shown high volatility. What to do now?

Recently we had an interview with “The Business Times” Singapore. Find out more about it here!

Prof. Kishore Mahbubani joins Aggregate Asset Management as chairman.