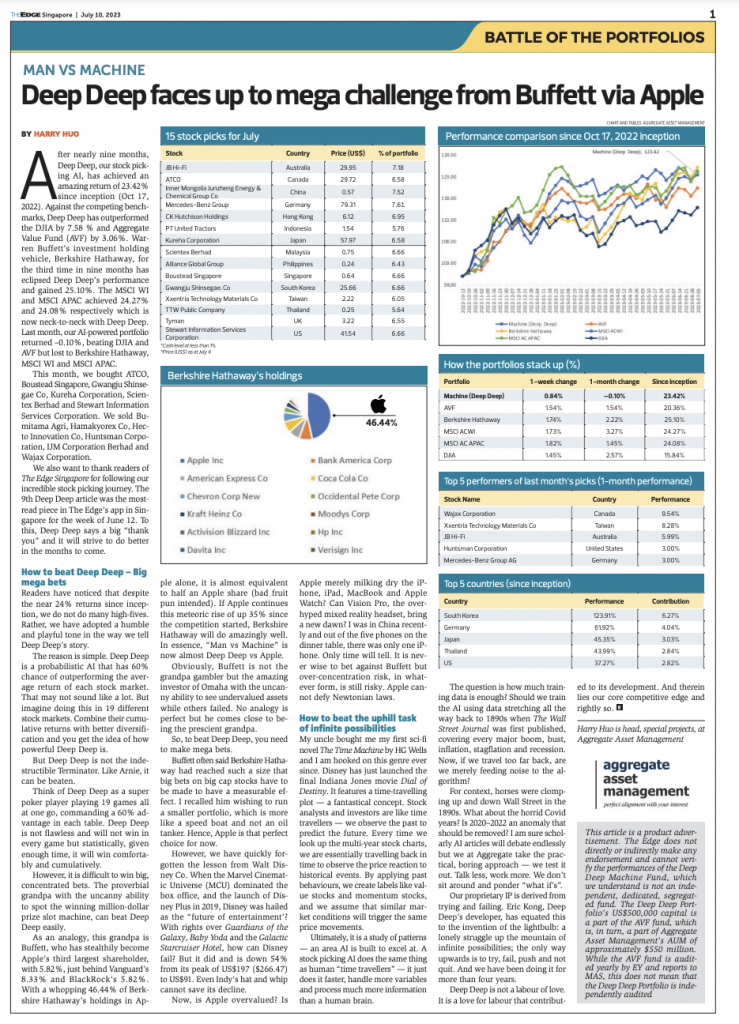

After nearly nine months, Deep Deep, our stock picking AI, has achieved an amazing return of 23.42% since inception (Oct 17, 2022). Against the competing benchmarks, Deep Deep has outperformed the DJIA by 7.58 % and Aggregate Value Fund (AVF) by 3.06%. Warren Buffett’s investment holding vehicle, Berkshire Hathaway, for the third time in nine months has eclipsed Deep Deep’s performance and gained 25.10%. The MSCI WI and MSCI APAC achieved 24.27% and 24.08% respectively which is now neck-to-neck with Deep Deep. Last month, our AI-powered portfolio returned –0.10%, beating DJIA and AVF but lost to Berkshire Hathaway, MSCI WI and MSCI APAC.

This month, we bought ATCO, Boustead Singapore F9D 0.59% , Gwangju Shinsegae Co, Kureha Corporation, Scientex Berhad and Stewart Information Services Corporation. We sold Bumitama Agri P8Z -0.88% , Hamakyorex Co, Hecto Innovation Co, Huntsman Corporation, IJM Corporation Berhad and Wajax Corporation.

We also want to thank readers of The Edge Singapore for following our incredible stock-picking journey. The 9th Deep Deep article was the most read piece in The Edge’s app in Singapore for the week of June 12. To this, Deep Deep says a big “thank you” and it will strive to do better in the months to come.

How to beat Deep Deep – Big mega bets

Readers have noticed that despite the near 24% returns since inception, we do not do many high-fives. Rather, we have adopted a humble and playful tone in the way we tell Deep Deep’s story.

The reason is simple. Deep Deep is a probabilistic AI that has 60% chance of outperforming the average return of each stock market. That may not sound like a lot. But imagine doing this in 19 different stock markets. Combine their cumulative returns with better diversification and you get the idea of how powerful Deep Deep is.

But Deep Deep is not the indestructible Terminator. Like Arnie, it can be beaten.

Think of Deep Deep as a super poker player playing 19 games all at one go, commanding a 60% advantage in each table. Deep Deep is not flawless and will not win in every game but statistically, given enough time, it will win comfortably and cumulatively.

However, it is difficult to win big, concentrated bets. The proverbial grandpa with the uncanny ability to spot the winning million-dollar prize slot machine, can beat Deep Deep easily.

As an analogy, this grandpa is Buffett, who has stealthily become Apple’s third largest shareholder, with 5.82%, just behind Vanguard’s 8.33% and BlackRock’s 5.82%. With a whopping 46.44% of Berkshire Hathaway’s holdings in Apple alone, it is almost equivalent to half an Apple share (bad fruit pun intended). If Apple continues this meteoric rise of up 35% since the competition started, Berkshire Hathaway will do amazingly well. In essence, “Man vs Machine” is now almost Deep Deep vs Apple.

Obviously, Buffett is not the grandpa gambler but the amazing investor of Omaha with the uncanny ability to see undervalued assets while others failed. No analogy is perfect but he comes close to being the prescient grandpa.

So, to beat Deep Deep, you need to make mega bets.

Buffett often said Berkshire Hathaway had reached such a size that big bets on big cap stocks have to be made to have a measurable effect. I recalled him wishing to run a smaller portfolio, which is more like a speed boat and not an oil tanker. Hence, Apple is that perfect choice for now.

However, we have quickly forgotten the lesson from Walt Disney Co. When the Marvel Cinematic Universe (MCU) dominated the box office, and the launch of Disney Plus in 2019, Disney was hailed as the “future of entertainment’? With rights over Guardians of the Galaxy, Baby Yoda and the Galactic Starcruiser Hotel, how can Disney fail? But it did and is down 54% from its peak of US$197 ($266.47) to US$91. Even Indy’s hat and whip cannot save its decline.

Now, is Apple overvalued? Is Apple merely milking dry the iPhone, iPad, MacBook and Apple Watch? Can Vision Pro, the overhyped mixed reality headset, bring a new dawn? I was in China recently and out of the five phones on the dinner table, there was only one iPhone. Only time will tell. It is never wise to bet against Buffett but over-concentration risk, in whatever form, is still risky. Apple cannot defy Newtonian laws.

How to beat the uphill task of infinite possibilities

My uncle bought me my first sci-fi novel The Time Machine by HG Wells and I am hooked on this genre ever since. Disney has just launched the final Indiana Jones movie Dial of Destiny. It features a time-travelling plot — a fantastical concept. Stock analysts and investors are like time travellers — we observe the past to predict the future. Every time we look up the multi-year stock charts, we are essentially travelling back in time to observe the price reaction to historical events. By applying past behaviours, we create labels like value stocks and momentum stocks, and we assume that similar market conditions will trigger the same price movements.

Ultimately, it is a study of patterns — an area AI is built to excel at. A stock-picking AI does the same thing as human “time travellers” — it just does it faster, handle more variables and process much more information than a human brain. The question is how much training data is enough? Should we train the AI using data stretching all the way back to 1890s when The Wall Street Journal was first published, covering every major boom, bust, inflation, stagflation and recession.

Now, if we travel too far back, are we merely feeding noise to the algorithm? For context, horses were clomping up and down Wall Street in the 1890s. What about the horrid Covid years? Is 2020–2022 an anomaly that should be removed? I am sure scholarly AI articles will debate endlessly but we at Aggregate take the practical, boring approach — we test it out. Talk less, work more. We don’t sit around and ponder “what if’s”. Our proprietary IP is derived from trying and failing.

Eric Kong, Deep Deep’s developer, has equated this to the invention of the lightbulb: a lonely struggle up the mountain of infinite possibilities; the only way upwards is to try, fail, push and not quit. And we have been doing it for more than four years. Deep Deep is not a labour of love. It is a love for labour that contributed to its development. And therein lies our core competitive edge and rightly so.

Harry Huo is head, special projects, at Aggregate Asset Management

This article is a product advertisement. The Edge does not directly or indirectly make any endorsement and cannot verify the performances of the Deep Deep Machine Fund, which we understand is not an independent, dedicated, segregated fund. The Deep Deep Portfolio’s US$500,000 capital is a part of the AVF fund, which is, in turn, a part of Aggregate Asset Management’s AUM of approximately $550 million. While the AVF fund is audited yearly by EY and reports to MAS, this does not mean that the Deep Deep Portfolio is independently audited.

To view all articles in the Man vs Machine Challenge series, please click here.

This article was published on The Edge Singapore on 06 July, 2023.