The Santa Rally never came, but Deep Deep, our machine learning AI, reigns supreme again

Important: Scam Alert! Caution of Impersonation / Telegram and/or Whatsapp Scams. Learn More >

The Santa Rally never came, but Deep Deep, our machine learning AI, reigns supreme again

We beat Berkshire Hathaway, AVF (our own fund), Dow Jones and MSCI Asia Pacific. Our worthy competitor, Mr Tong’s portfolio, rode on the Asian markets’ recovery by picking several Asian big-cap stocks and bond funds (a different asset class), thereby achieving an awesome 13.51% return. Our congratulations to Mr Tong but the game is still afoot.

First-month results of the Battle of the Portfolios are out! Our AI called Deep Deep has performed admirably well, achieving 4.46% monthly return against the competing portfolios. From the comparison table, we can see that Deep Deep edged out Tong’s Portfolio by 2.38% and our very own Aggregate Value Fund by 0.83%.

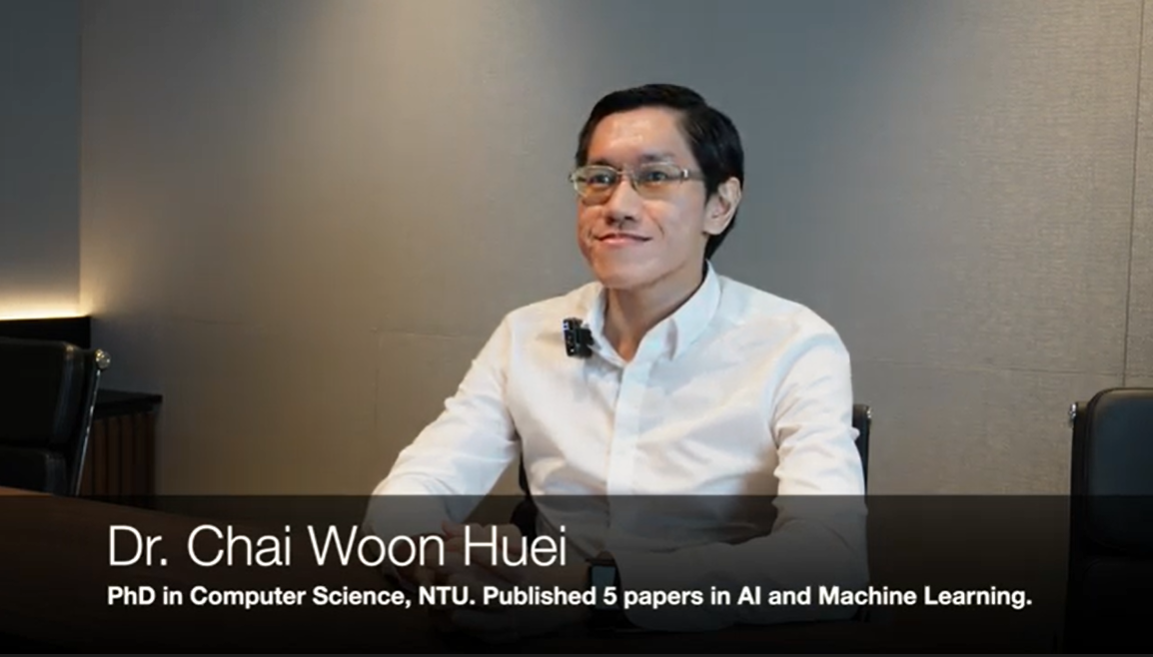

The Aggregate Series is a new series of interviews featuring the fund management team and staff of Aggregate Asset Management. This series kicks off by featuring Dr Chai Woon Huei, our data scientist and quantitative researcher.

Presently, we use AI as a stock screener to add value to our decision-making process. Join us in this AI discovery journey and may the best portfolio — man vs machine; concentrated vs diversified, win.

Aggregate Asset Management has unlocked the formula on how best to use machine learning in picking winning stocks. The success of AI applications in finance and investments will be discovered in this article.