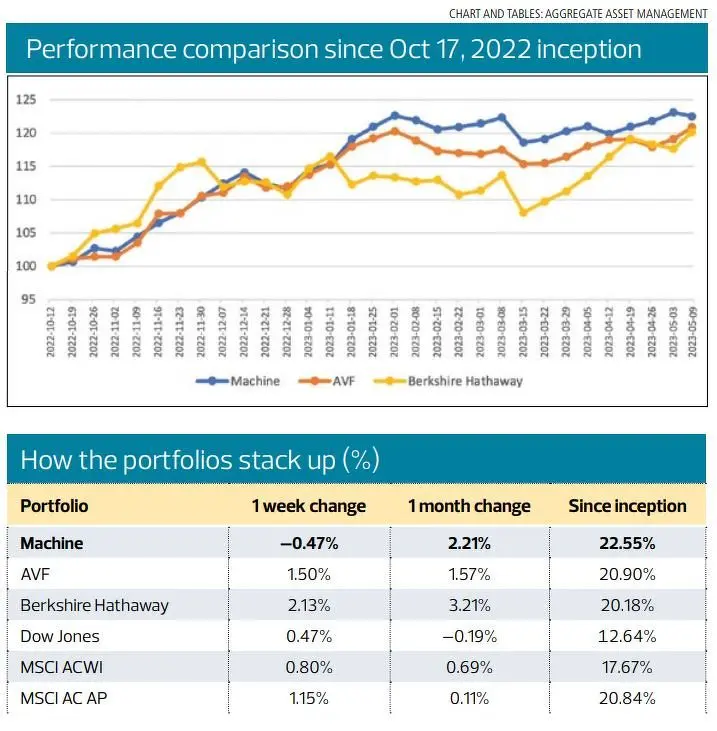

The winning streak of our stock-picking AI, Deep Deep, continues. Since its inception on Oct 17, Deep Deep’s portfolio has returned 22.55%, winning all the competitors’ portfolios (Berkshire Hathaway by 2.37% and Aggregate Value Fund (AVF) by 1.64%) and all the competing benchmarks.

Over the past month, our machine learning AI has risen 2.21%, beating MSCI All Country World Index, MSCI All Country Asia Pacific All Cap Index, Dow Jones Industrial Average and AVF except Berkshire Hathaway.

Using a vanilla “buy and hold” strategy with just 15 stocks from 15 countries with no leverage, no sectoral concentration, no thematic bet, no bonds and treasury bills, Deep Deep has beaten everyone and everything.

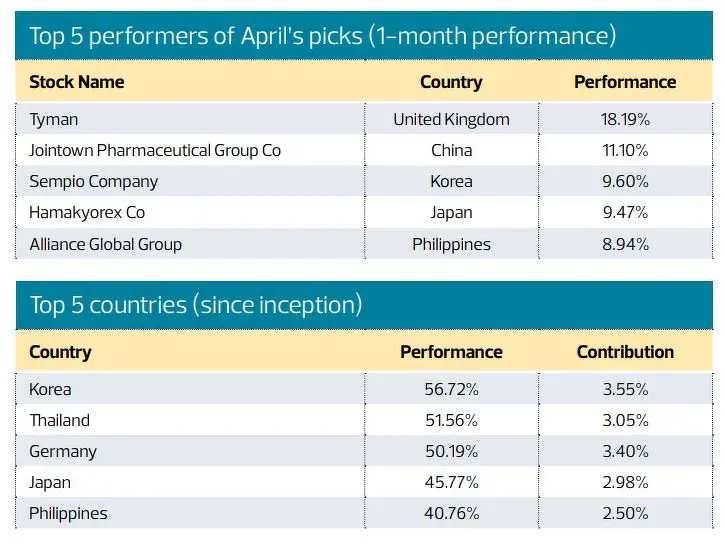

This month, we bought Bumitama Agri, Neooto Co, Xxentria Technology Materials, PT United Tractors and Huaihe Energy. On the other hand, we sold Hutchison Port Trust, Sempio Co, Bai Sha Technology, PT Bukit Asam and Jointown Pharmaceutical.

How do you make an AI?

Readers have asked me: How do you “make” an AI? Most laymen think AI is some out-of-reach computer science field that only the gifted and those cool, brooding hackers like Elliot Anderson in Mr Robot can handle. Can you explain this in simple words, they ask? Challenge accepted. Let us try to demystify AI in 30 words. How do you start an AI project?

1. Import data

2. Clean data

3. Split data into training set vs testing set

4. Create model

5. Train model using training set

6. Test model using testing set

7. Evaluate results and improve model

We may not fully understand the process but just by reading the seven major steps, we will intuitively get this — it is feeding tons of data into a software so that it learns to recognise patterns and you keep testing it to see if the software has predictive power. Wash, rinse and repeat until you get it right. You need perseverance and resilience.

I have mentioned before in this series that the AI development process is akin to inventing the lightbulb. To me, this is the irreplaceable, priceless value of a data scientist — his steadfast mind to deal with endless failures until it works. It is 20% brilliant insight and 80% pure brute force, repetitive work.

That is our secret sauce. It is our selection of more than 150 financial indicators, the simplification of the Deep Deep model into a digital outcome (instead of predicting the stock prices which many have tried and failed) and the endless testing, debugging and validation that created Deep Deep. Our team took four years to develop the AI and we are still improving it.

What’s the problem with AI?

AI is not flawless and invincible. We have often said there is a 60% probability our AI can beat the market which translates to around 6% outperformance above the market performance. Imagine going to the casino with a 6% advantage!

However, one of the biggest problems with AI is transparency and traceability. The AI may be able to predict an outcome but it cannot precisely explain why it reaches that decision in a succinct, easy-to-understand manner.

This is a much-quoted story about a medical research team using AI to predict malignant skin cancer just by scanning the photos of the skin tumours of patients. To the joy of the researchers, the AI worked miraculously with predictive power far exceeding human doctors.

Then a smart researcher realised this — when a tumour is malignant, they tend to use a ruler to measure its size and that ruler was included in the photo.

So, they were essentially training the AI to look for rulers rather than detecting skin cancer! Had they implemented the “successful” AI, it would have been disastrous and kudos to the researcher who discovered the error.

The stock that we did not buy

We want to use this opportunity to highlight the importance of human analysis in stock pickings despite possessing a powerful AI like Deep Deep.

Since September last year, Intel has been highly ranked by Deep Deep. Month after month, Intel was chosen by Deep Deep as top 3 in our US stock rankings. We know that Intel has fallen from its lofty perch. Today, Intel is undervalued at 1.15x price to book value versus its historical fiveyear average of 2.7x as well as the semiconductor industry P/B at 12x.

So, logic dictates that at a certain point, Intel’s stock price will revert to the mean. With the US Congress passing its Chips Act and Intel’s commitment to building the world’s largest chip-making complex, we know Intel is poised to make a comeback. It is a question of when — not if.

When we ask Deep Deep to evaluate US stocks with an emphasis on value investment rules, Intel was top 3 on Deep Deep’s radar for several months. Hence, it begs the question — should we buy Intel as a value stock?

No, we did not.

That final decision was made by our human analyst team. One of our analysts, Cheen Wee Kiang, summed it eloquently: “We did not buy Intel because looking at the fundamentals versus its peers like AMD and Nvidia, Intel really trails behind.”

This turns out to be the right decision as Intel’s share price did not perform well. Eric Kong, as head of the investment team and developer of Deep Deep, has empowered all of us to speak our minds. Our fund manager, Lam Ji Ming, and our analysts, Belfort Tan and Wee Kiang, are allowed to override Deep Deep’s picks as long as there is a valid justification.

What if we are wrong and Deep Deep is right? That is when the power of diversification kicks in. We have 14 other stocks in the Deep Deep portfolio which are all highest ranked in their respective countries. Missing one Intel does not spell the end of the world for us. Similarly, our AVF portfolio will have 500 stocks by the end of the year and Intel’s impact will be even lesser.

The real winning advantage

With the likes of ChatGPT and transformative AI engines, there will be more competitors in the AI-powered stock portfolio management space. After all, buying and selling stocks, bull and bear runs, and fundamental and technical analysis are all about pattern recognition. We also foresee financial data providers developing their own trading AI since whoever has data is king. So far, Aggregate has the first mover’s advantage.

But I surmise that having a set of codes is not enough. You may have a powerful software AI. You may have some lightning-fast hardware to crunch the data. But many will lack the heart-ware and the will.

Like the researchers who thought they had brilliantly invented an AI that could spot skin cancer, you need humans to obsessively test if the AI is working. You need that ruler spotter in the team. You need humans who dare to speak up and override the AI.

While we don’t buy Intel now, we abide by former Intel CEO Andy Grove’s dictum “only the paranoid survive”, which runs deep in Aggregate’s DNA. Every week, we do due diligence to see if our algorithm is on track. More importantly, you also need a management that has the foresight and patience to take the long view. We do not rush adopting AI because it is trendy. We do so because it works. And works supremely.

If Deep Deep has a real voice, it will say: “Aggregate has The Right Stuff.”

Harry Huo is head, special projects, at Aggregate Asset Management

This article is a product advertisement. The Edge does not directly or indirectly make any endorsement and cannot verify the performances of the Deep Deep Machine Fund, which we understand is not an independent, dedicated, segregated fund. The Deep Deep Portfolio’s US$500,000 capital is a part of the AVF fund, which is, in turn, a part of Aggregate Asset Management’s AUM of approximately $550 million. While the AVF fund is audited yearly by EY and reports to MAS, this does not mean that the Deep Deep Portfolio is independently audited

To view all articles in the Man vs Machine Challenge series, please click here.

This article was published on The Edge Singapore on 11 May, 2023.