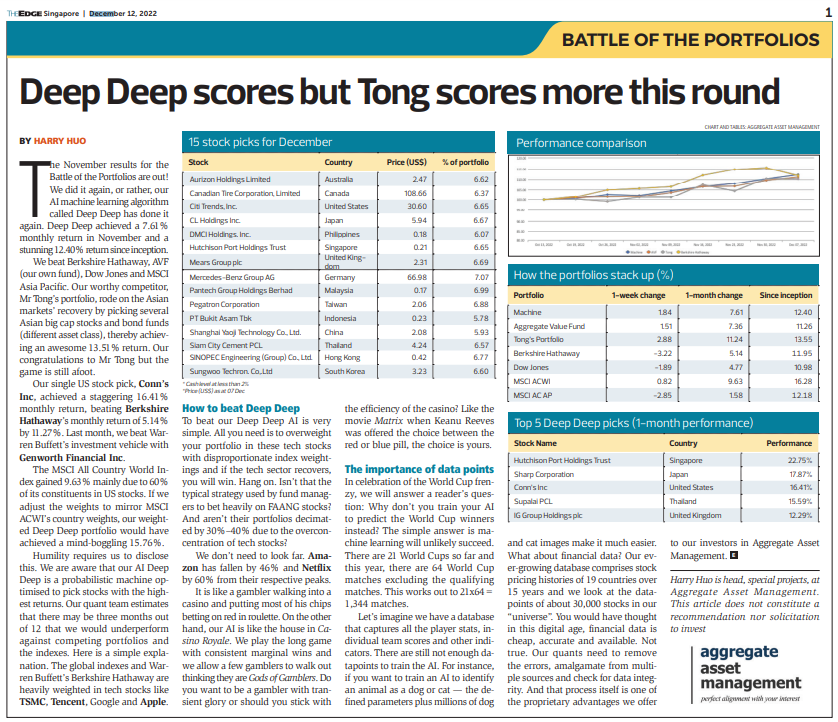

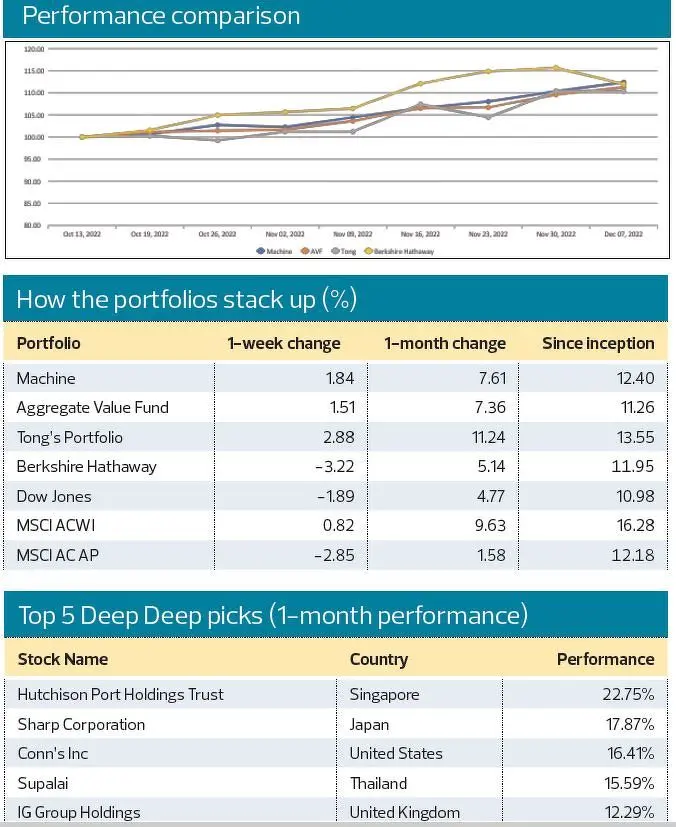

We beat Berkshire Hathaway, AVF (our own fund), Dow Jones and MSCI Asia Pacific. Our worthy competitor, Mr Tong’s portfolio, rode on the Asian markets’ recovery by picking several Asian big-cap stocks and bond funds (a different asset class), thereby achieving an awesome 13.51% return. Our congratulations to Mr Tong but the game is still afoot.

Our single US stock pick, Conn’s Inc, achieved a staggering 16.41% monthly return, beating Berkshire Hathaway’s monthly return of 5.14% by 11.27%. Last month, we beat Warren Buffett’s investment vehicle with Genworth Financial Inc. The MSCI All Country World Index gained 9.63% mainly due to 60% of its constituents in US stocks. If we adjust the weights to mirror MSCI ACWI’s country weights, our weighted Deep Deep portfolio would have achieved a mind-boggling 15.76%.

Humility requires us to disclose this. We are aware that our AI Deep Deep is a probabilistic machine optimised to pick stocks with the highest returns. Our quant team estimates that there may be three months out of 12 that we would underperform against competing portfolios and the indexes. Here is a simple explanation. The global indexes and Warren Buffett’s Berkshire Hathaway are heavily weighted in tech stocks like TSMC, Tencent, Google and Apple.

How to beat Deep Deep

To beat our Deep Deep AI is very simple. All you need is to overweight your portfolio in these tech stocks with disproportionate index weightings and if the tech sector recovers, you will win. Hang on. Isn’t that the typical strategy used by fund managers to bet heavily on FAANG stocks? And aren’t their portfolios decimated by 30%–40% due to the overconcentration of tech stocks?

We don’t need to look far. Amazon has fallen by 46% and Netflix by 60% from their respective peaks. It is like a gambler walking into a casino and putting most of his chips betting on red in roulette. On the other hand, our AI is like the house in Casino Royale. We play the long game with consistent marginal wins and we allow a few gamblers to walk out thinking they are the God of Gamblers. Do you want to be a gambler with transient glory or should you stick with the efficiency of the casino? It’s like in the Matrix movie when Keanu Reeves was offered the red pill or the blue pill. The choice is yours.

The importance of data points

In celebration of the World Cup frenzy, we will answer a reader’s question: Why don’t you train your AI to predict the World Cup winners instead? The simple answer is machine learning will unlikely succeed. There are 21 World Cups so far and this year, there are 64 World Cup matches excluding the qualifying matches. This works out to 21×64= 1,344 matches.

Let’s imagine we have a database that captures all the player stats, individual team scores and other indicators. There are still not enough datapoints to train the AI. For instance, if you want to train an AI to identify an animal as a dog or cat — the defined parameters plus millions of dog and cat images make it much easier. What about financial data? Our ever-growing database comprises stock pricing histories of 19 countries over 15 years and we look at the datapoints of about 30,000 stocks in our “universe”. You would have thought in this digital age, financial data is cheap, accurate and available. Not true. Our quants need to remove the errors, amalgamate from multiple sources and check for data integrity. And that process itself is one of the proprietary advantages we offer to our investors in Aggregate Asset Management.

To view all articles in the Man vs Machine Challenge series, please click here.

This article was published on The Edge Singapore on 12 December, 2022.