Recently, Aggregate Asset Management, in partnership with The Edge Singapore, held an engaging webinar – ‘Managing Global Uncertainties; Seizing Global Opportunities’. One of the topics discussed was,’ The Important Tenets of Investing, to Successfully Navigate through Tumultuous Times.’ where our Executive Director and Partner, Eric Kong, shared his views. This article is a summary of the sharing.

Well, what exactly is the perpetual energy machine?

Throughout history, people have tried to invent one – a machine that can actually be in motion forever, without the aid of additional energy.

The truth is, it is not possible as it violates all the laws of thermodynamics.

However, what is impossible in the world of science, is possible in the world of finance.

In this world, the perpetual energy machine not only generates perpetual energy, it snowballs as well.

It is in fact, the secret of the rich.

With the use of this formula, you’ll know why the rich keep getting richer, why the gap keeps getting wider, and why the poor remain, well, poor?

Let’s try and demonstrate how it all works in detail.

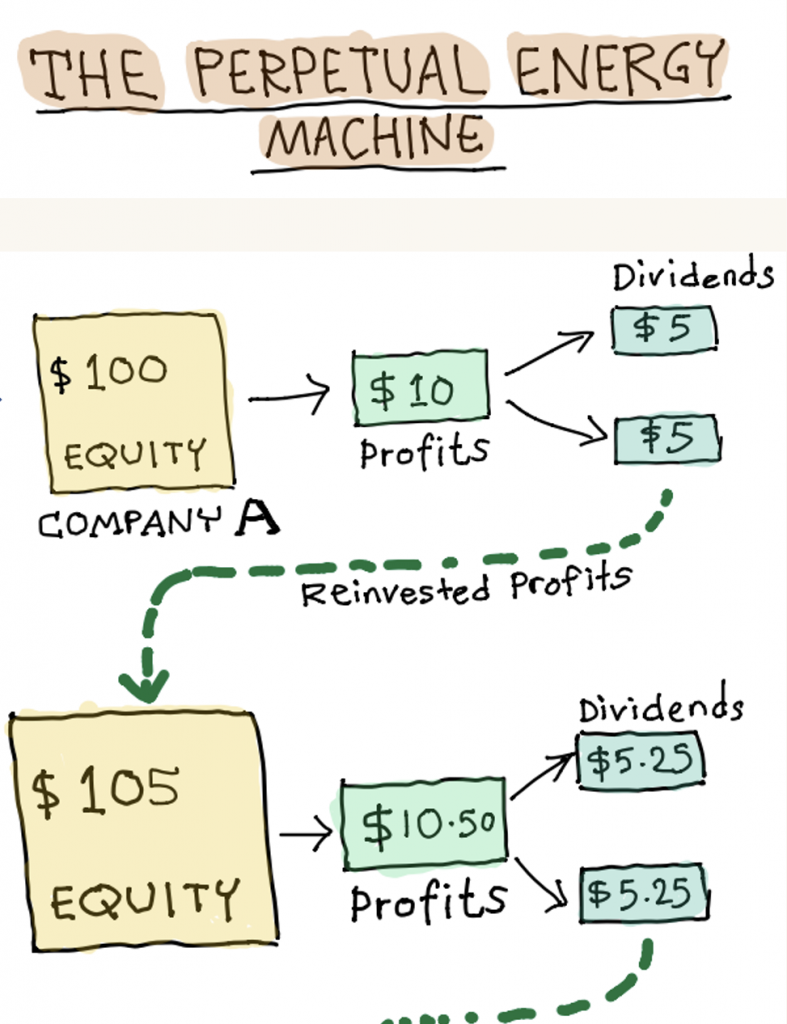

Take for example, you buy stock in Company A – which means you are buying a share in their business.

Let’s say you put in a capital of $100.

And after 1 year, if it runs an ROE (Return On Equity) of 10%, you’re going to make a profit of $10.

It’s simple right – for an investment of $100, you get a profit of $10.

But what then happens to your $10 profit?

Well, $5 goes out as dividend, while the remaining $5 is reinvested profit.

Which simply means, it goes back into the company. With this, the company now has a bigger base of $105.

As you can see, it has grown slightly.

If the profits are reinvested properly at10%, in the next year, what you will get is $10.50 in profit.

Notice, the profit has increased slightly as well.

This is then split into dividends – the shareholder gets $5.25, while the other $5.25 cents goes back into the company.

Once again, the company’s base gets a little bigger.

So where is the magic here?

Well, as you can see, with a bigger base, the dividends got bigger over time, and the profits got bigger over time as well.

Not only is this perpetual energy, it also generates more profit every time – so the snowball effect continues.

From the above demonstration, it would be the smart thing to be in this game more than in any other.

Compare it to bitcoin and you’ll further realise why value investing is much more lucrative.

Because with bitcoin, you don’t have such a mechanism – it doesn’t get bigger, and nothing gets reinvested.

You have no choice but to depend on another person to take it off your hand at a higher price.

You pray and hope this is going to happen. And based on recent outcomes, you know it didn’t.

If you can understand all this, then you will not feel the need to do the wrong thing, especially during market panics. Come discover how Aggregate Asset Management implements the Perpetual Energy Machine in its investing strategy. If you’re keen to gain a deeper understanding and explore your options, contact us and request for an appointment. We look forward to guiding you to become an investing success. Even in times of great volatility.