Dec 2021 AGEF Fund Report

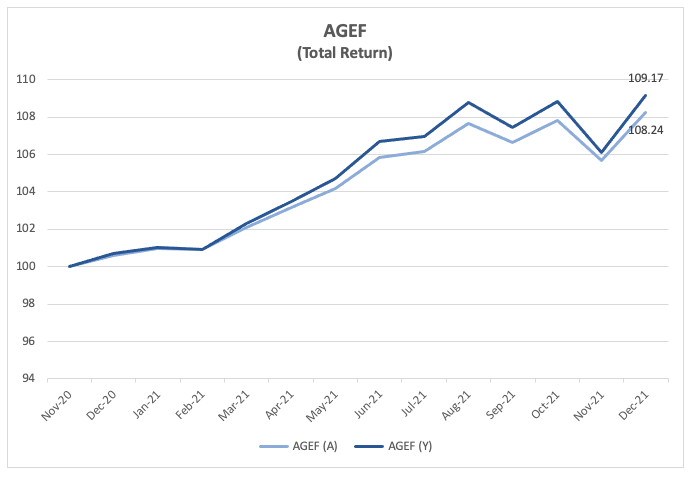

Nett NAV per Share:

Class A – SGD 108.24

Class Y – SGD 109.17

Fund Size

SGD 51.15 Million

The only problem with market timing is getting the timing right

Peter Lynch

Objective & Strategy

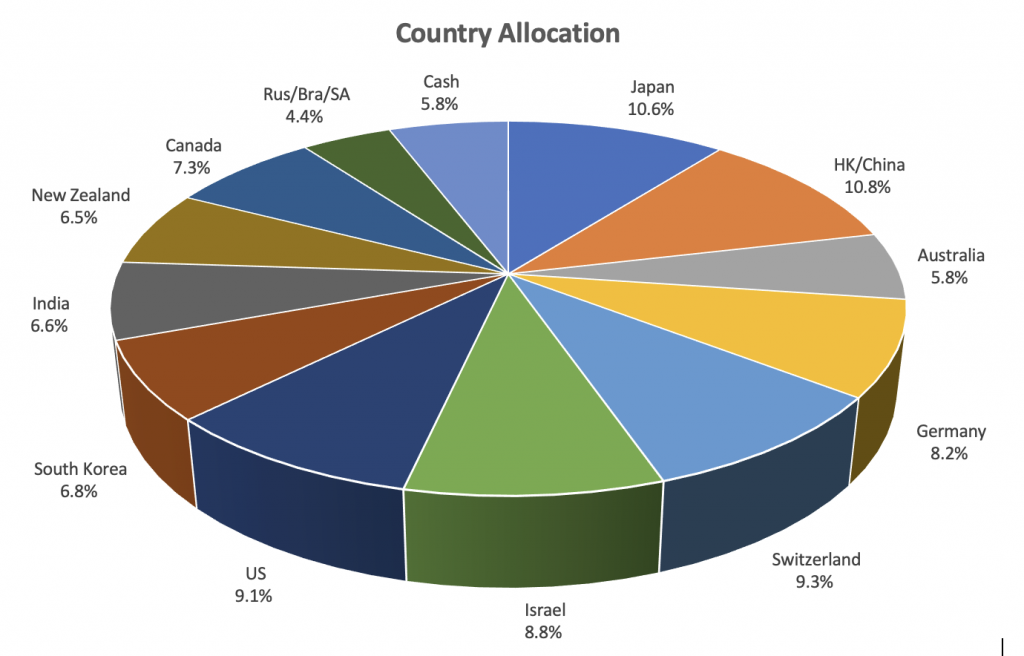

Our goal is to create a resilient portfolio that investors can use as a core for their long-term investment in the global equity market. The fund’s strategy involves a systematic two stage process which combines a country allocation approach and stock selection method. Our country allocation approach seeks to balance risk concentration and country returns, taking into account country volatility and valuation as well as correlations across countries. The stock selection process uses machine learning to capture alpha within each country. An equal weighted (rather than market capitalization weighted) approach will be used for stock allocation in each country with the emphasis on reducing risk concentration.

Country Allocation & Weights

Portfolio Overview

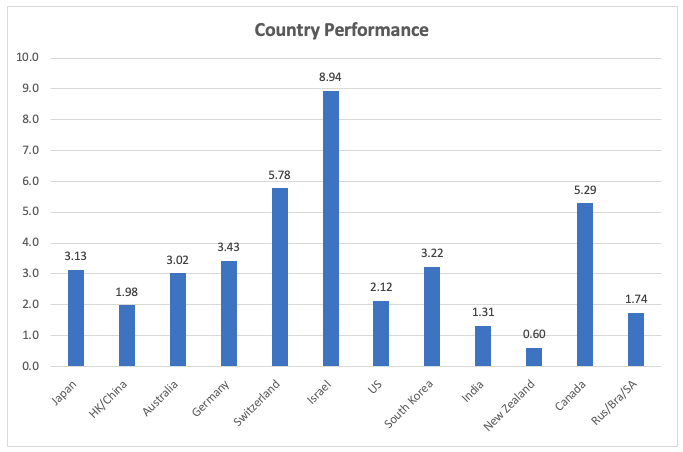

December 2021 was a good month with all the markets we have invested in heading north. The fund ended up handsomely with our Israel position again leading the way with a gain of 8.94% for the month.

NAV per share climbed +2.41% for Class A and +2.90% for Class Y shares. The MSCI All Country World Index (we measure the ACWI ETF) gained 3.89% in US dollar terms and +2.28% in Singapore dollar terms.

Positioning for 2022

We hope everyone had a good Christmas and holiday over the new year period. A common question we get asked from clients recently is how to position one’s investment portfolio for 2022. While most people are happy they have had positive returns in 2021, they worry about how much the markets have gone up even with a pandemic still continuing.

So, what’s an investor to do? If you ask ten different people, you’ll get ten different opinions depending on one’s optimism about the market and risk appetite. With the beginning of the new year, it’s always a good time to review one’s portfolio. If there is too much in speculative investment, then it may be wise to lighten up and rebalance it into core holdings. If one has played it safe, it may be good to add more to higher return or more speculative type investments, depending, of course, on your own personal situation. As always, the general advice is that the more speculative the investment, the smaller the proportion of total net wealth it should constitute while core holdings should constitute a larger proportion. Consider the risk and reward in each investment and only invest what you are comfortable with. Everyone chooses how well they want to sleep at night.

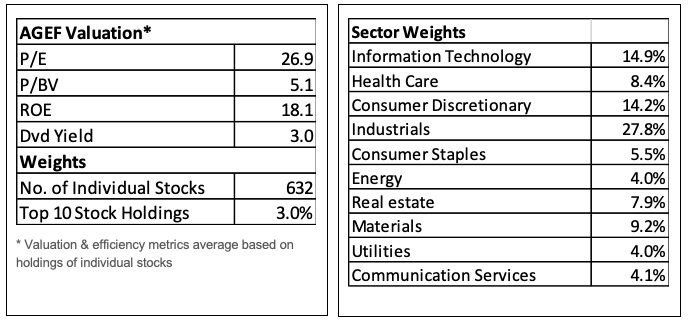

Over the course of the past year, the Aggregate Global Equities Fund has consistently executed a strategy to build fund resilience. We have diversified our investments widely across many countries in different regions of the world. We have invested in hundreds of companies with the aid of machine learning tools to obtain statistical advantage and we have been careful to avoid industry concentration risk. We believe we are well positioned to ride out the coming year which, no doubt, will be full of events that will surprise us. We are grateful to all of you for your support!

Wishing everyone a healthy and happy 2022 and a prosperous year of the Tiger!

Lam Ji Ming, David Loh & Eric Kong,

For The Aggregate Global Equities Fund