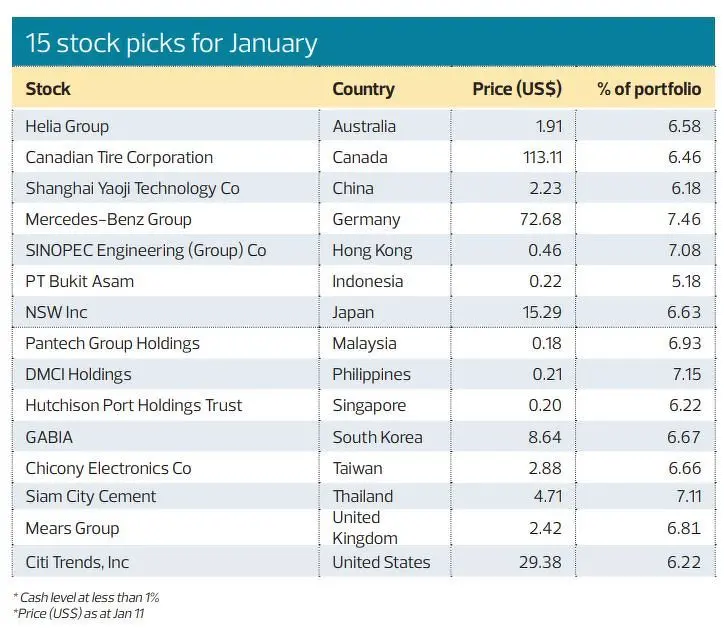

The Santa Rally never came, but Deep Deep, our machine learning AI, reigns supreme again. Over the past month, the MSCI WI and MSCI APAC have risen 0.44% and 1.44% respectively. For the same period, DJI has been flat at 0.06%, Tong’s Portfolio fell by 0.86% and Aggregate own fund, Aggregate Value Fund (AVF), was up at 1.68%. Deep Deep showed a gain of 1.04% outperforming Tong’s Portfolio, Dow Jones and MSCI ACWI.

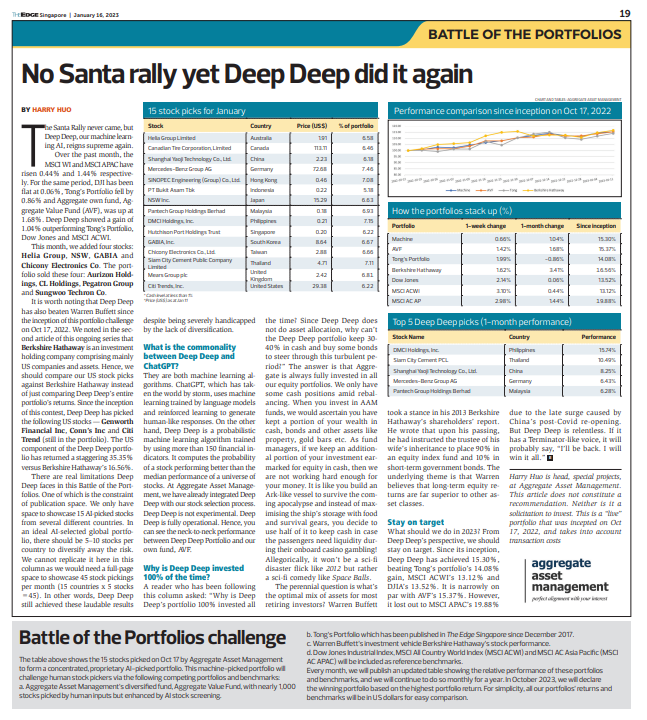

This month, we added four stocks: Helia Group, NSW, GABIA and Chicony Electronics Co. The portfolio sold these four: Aurizon Holdings, CL Holdings, Pegatron Group and Sungwoo Techron Co.

It is worth noting that Deep Deep has also beaten Warren Buffett since the inception of this portfolio challenge on Oct 17, 2022. We noted in the second article of this ongoing series that Berkshire Hathaway is an investment holding company comprising mainly US companies and assets. Hence, we should compare our US stock picks against Berkshire Hathaway instead of just comparing Deep Deep’s entire portfolio’s returns. Since the inception of this contest, Deep Deep has picked the following US stocks — Genworth Financial Inc, Conn’s Inc and Citi Trend (still in the portfolio). The US component of the Deep Deep portfolio has returned a staggering 35.35% versus Berkshire Hathaway’s 16.56%.

There are real limitations Deep Deep faces in this Battle of the Portfolios. One of which is the constraint of publication space. We only have space to showcase 15 AI-picked stocks from several different countries. In an ideal AI-selected global portfolio, there should be 5–10 stocks per country to diversify away the risk. We cannot replicate it here in this column as we would need a full-page space to showcase 45 stock pickings per month (15 countries x 5 stocks =45). In other words, Deep Deep still achieved these laudable results despite being severely handicapped by the lack of diversification.

What is the commonality between Deep Deep and ChatGPT?

They are both machine learning algorithms. ChatGPT, which has taken the world by storm, uses machine learning trained by language models and reinforced learning to generate human-like responses. On the other hand, Deep Deep is a probabilistic machine learning algorithm trained by using more than 150 financial indicators. It computes the probability of a stock performing better than the median performance of a universe of stocks. At Aggregate Asset Management, we have already integrated Deep Deep with our stock selection process. Deep Deep is not experimental. Deep Deep is fully operational. Hence, you can see the neck-to-neck performance between Deep Deep Portfolio and our own fund, AVF.

Why is Deep Deep invested 100% of the time?

A reader who has been following this column asked: “Why is Deep Deep’s portfolio 100% invested all the time? Since Deep Deep does not do asset allocation, why can’t the Deep Deep portfolio keep 30- 40% in cash and buy some bonds to steer through this turbulent period?” The answer is that Aggregate is always fully invested in all our equity portfolios. We only have some cash positions amid rebalancing. When you invest in AAM funds, we would ascertain you have kept a portion of your wealth in cash, bonds and other assets like property, gold bars etc.

As fund managers, if we keep an additional portion of your investment earmarked for equity in cash, then we are not working hard enough for your money. It is like you build an Ark-like vessel to survive the coming apocalypse and instead of maximising the ship’s storage with food and survival gears, you decide to use half of it to keep cash in case the passengers need liquidity during their onboard casino gambling! Allegorically, it won’t be a sci-fi disaster flick like 2012 but rather a sci-fi comedy like Space Balls.

The perennial question is what’s the optimal mix of assets for most retiring investors? Warren Buffett took a stance in his 2013 Berkshire Hathaway’s shareholders’ report. He wrote that upon his passing, he had instructed the trustee of his wife’s inheritance to place 90% in an equity index fund and 10% in short-term government bonds. The underlying theme is that Warren believes that long-term equity returns are far superior to other asset classes.

Stay on target

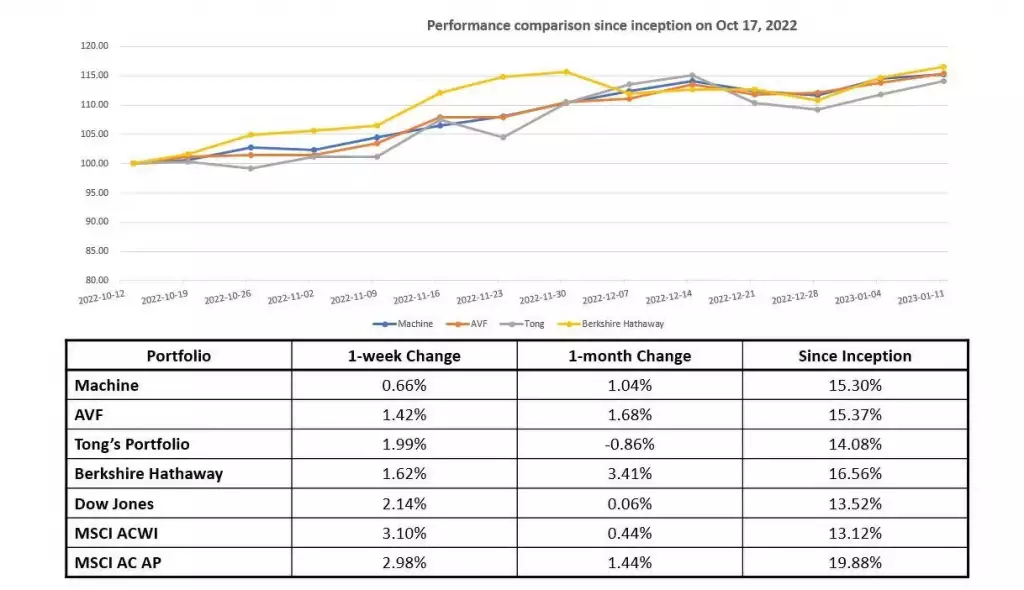

What should we do in 2023? From Deep Deep’s perspective, we should stay on target. Since its inception, Deep Deep has achieved 15.30%, beating Tong’s portfolio’s 14.08% gain, MSCI ACWI’s 13.12% and DJIA’s 13.52%. It is narrowly on par with AVF’s 15.37%. However, it lost out to MSCI APAC’s 19.88% due to the late surge caused by China’s post-Covid re-opening. But Deep Deep is relentless. If it has a Terminator-like voice, it will probably say, “I’ll be back. I will win it all.”

To view all articles in the Man vs Machine Challenge series, please click here.

This article was published on The Edge Singapore on 12 January, 2023.