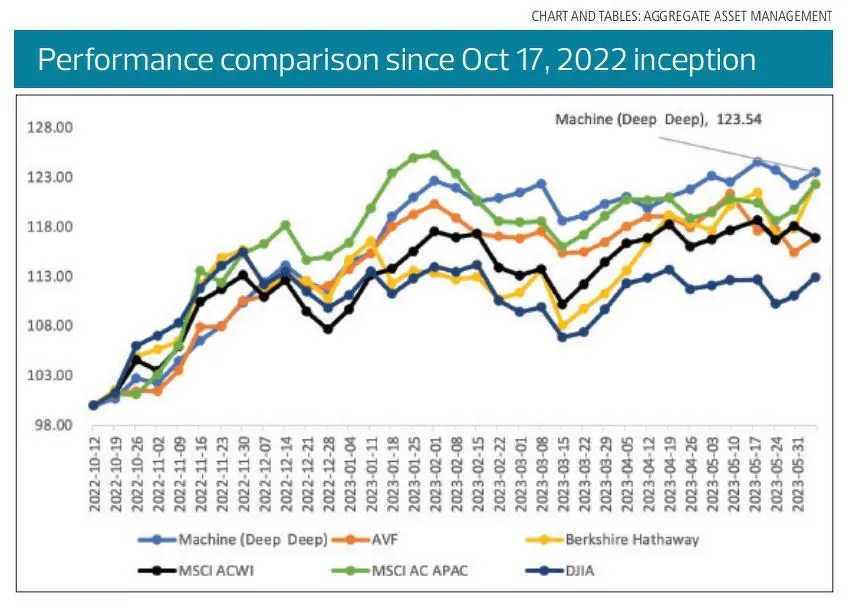

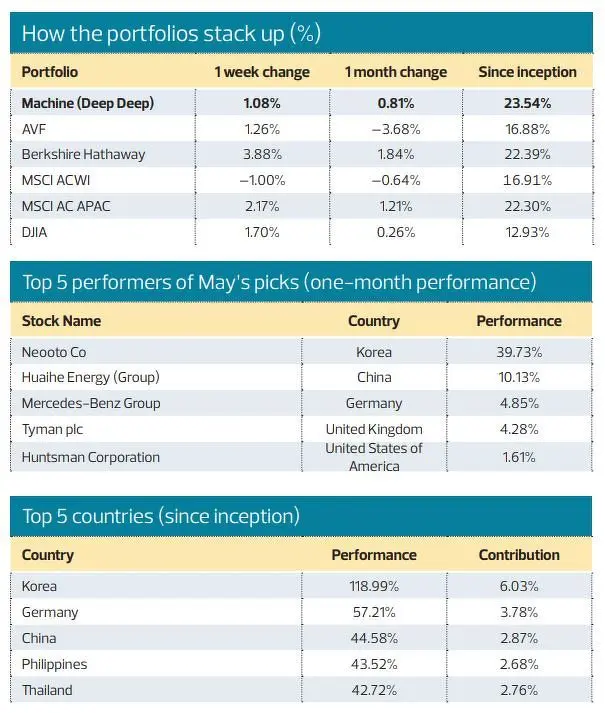

Deep Deep, our machine learning AI, is still top of the charts after nearly eight months. Since its inception (Oct 17, 2022), Deep Deep’s portfolio has reigned supreme with 23.54% returns, beating Berkshire Hathaway by 1.15% and Aggregate Value Fund (AVF) by 6.66%.

Against the competing benchmarks, Deep Deep has outperformed the MSCI All Country World Index by 6.63%, MSCI All Country Asia Pacific All Cap Index by 1.24% and the Dow Jones Industrial Average by 10.61%. In the last month, our AI-powered portfolio has returned 0.81%, beating MSCI ACWI, DJIA and AVF but lost to Berkshire Hathaway and MSCI APAC.

We accomplished these results without leverage, derivatives, bonds, corporate action, program trading and sectoral concentration bets. And no fancy crypto. It is old school “buy and hold” strategy with 15 stocks from 15 different countries, rebalanced monthly. Our AI is cutting-edge, but our investments are old age — pun intended.

This month we bought Hecto Innovation and Inner Mongolia Junzheng Energy & Chemical Group and sold Neooto and Huaihe Energy Group.

Big Boys will get into AI game

A reader asked: “I like your sterling results so far but you do not have the financial firepower of, say, a tech giant like Google or a US investment bank. With all the attention on AI now, won’t Deep Deep becomes obsolete in the AI race?”

Obsolescence is something we think about all the time. No one can claim to be at the forefront forever. But we are convinced we have something special. As explained in previous articles, we use more than 150 indicators to train our AI comprising 50 fundamental indicators, 50 technical indicators and 50 generated indicators by academic journals.

We believe one of our core competitive uniqueness is these journals’ indicators. Our competitors can easily buy financial data with the myriad of financial indicators thrown in to train their AIs but it took years to digest the academic publications, translate them into meaningful financial indicators and then use them to train and test our AI — a process known as feature engineering.

Think about this. An academic has spent decades or perhaps his lifetime to research and publish observations of market phenomena but Wall Street hardly pays any attention to such obscure discoveries. Except us. In Aggregate, we “weaponise” them into stock picking tools and therein lies our first mover’s advantage. It will take years for the rest to catch up.

A tribute to Fast & Furious

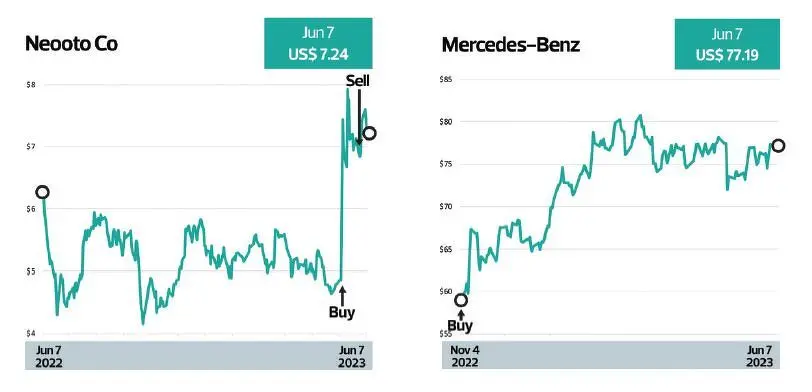

Since the movie theatres are still showing Fast X, we will talk about the car-related industry. South Korea’s Neooto Co is a car parts supplier to Hyundai and other car makers. We bought the shares on May 9 at US$4.90 ($6.61), and sold on May 30 at US$6.90, netting a phenomenal 41% return in less than a month! Our analysts were puzzled as there were no earth-shattering news of any kind. Deep Deep had picked it as a value stock and also a reverse momentum stock. So, we picked the stock because it is the best of both worlds and in this case, best of both filters.

As explained in our webinar, we know the clusters of financial indicators that are impactful to stock price movements but we do not know exactly which indicators gave pre-emptive signals that the stock rise is imminent. Our $500 million AVF fund, powered by Deep Deep’s AI, obviously has more than 15 stocks compared to this portfolio shown in The Edge Singapore. We see such occurrences quite regularly — Deep Deep recommends a stock and nothing happens to the stock as there is no news. Suddenly the stock price starts trending up or even shooting up. There is no magic or superpower here. Deep Deep is merely a predictive model that sees patterns we humans fail to detect.

Benz, Tesla and Volkswagen

Another stock that is worth analysing is Mercedes Benz Group, part of Deep Deep’s portfolio since Nov 4 2022. From US$61 then, we’ve gained 25% in seven months. Investors are all fawning over big EV plays such as BYD and Tesla, which has dropped 7% in contrast. What is new and shiny may not be a sure win.

One indicator we used in our predictive AI is R&D expenses divided by market capitalisation. Volkswagen’s 2021 R&D expenses were EUR16 billion ($23.1 billion), double Mercedes’ EUR8 billion. By that metric, Volkswagen should be a better stock.

However, the devil is in the details. By looking at all 150 financial indicators “simultaneously”, before deriving a “buy” ranking, Deep Deep picked Mercedes instead. In contrast, we human analysts, at our very best, can only handle 10 indicators, let alone their complex permutations. Therein lies the power of the all-seeing Deep Deep.

Deep Deep’s human team in Aggregate. From left, Belfort Tan, Cheen Wee Kiang, Harry Huo, Eric Kong, Lam Ji Ming and Chai Woon Huei / Photo: Aggregate Asset Management

Throughout this series, I have always emphasised the need for human intelligence and resilience, combined with AI that made the difference. Deep Deep is a cobot. Making all this possible are the analysts, data scientist, fund manager and AI developer in the photo, backed by everyone else at Aggregate. Vin Diesel, who plays Don in Fast and Furious, would have said, “It is all about family.” The only difference is one of us in Aggregate is silicon.

Harry Huo is head, special projects, at Aggregate Asset Management

This article is a product advertisement. The Edge does not directly or indirectly make any endorsement and cannot verify the performances of the Deep Deep Machine Fund, which we understand is not an independent, dedicated, segregated fund. The Deep Deep Portfolio’s US$500,000 capital is a part of the AVF fund, which is, in turn, a part of Aggregate Asset Management’s AUM of approximately $550 million. While the AVF fund is audited yearly by EY and reports to MAS, this does not mean that the Deep Deep Portfolio is independently audited.

To view all articles in the Man vs Machine Challenge series, please click here.

This article was published on The Edge Singapore on 08 June, 2023.