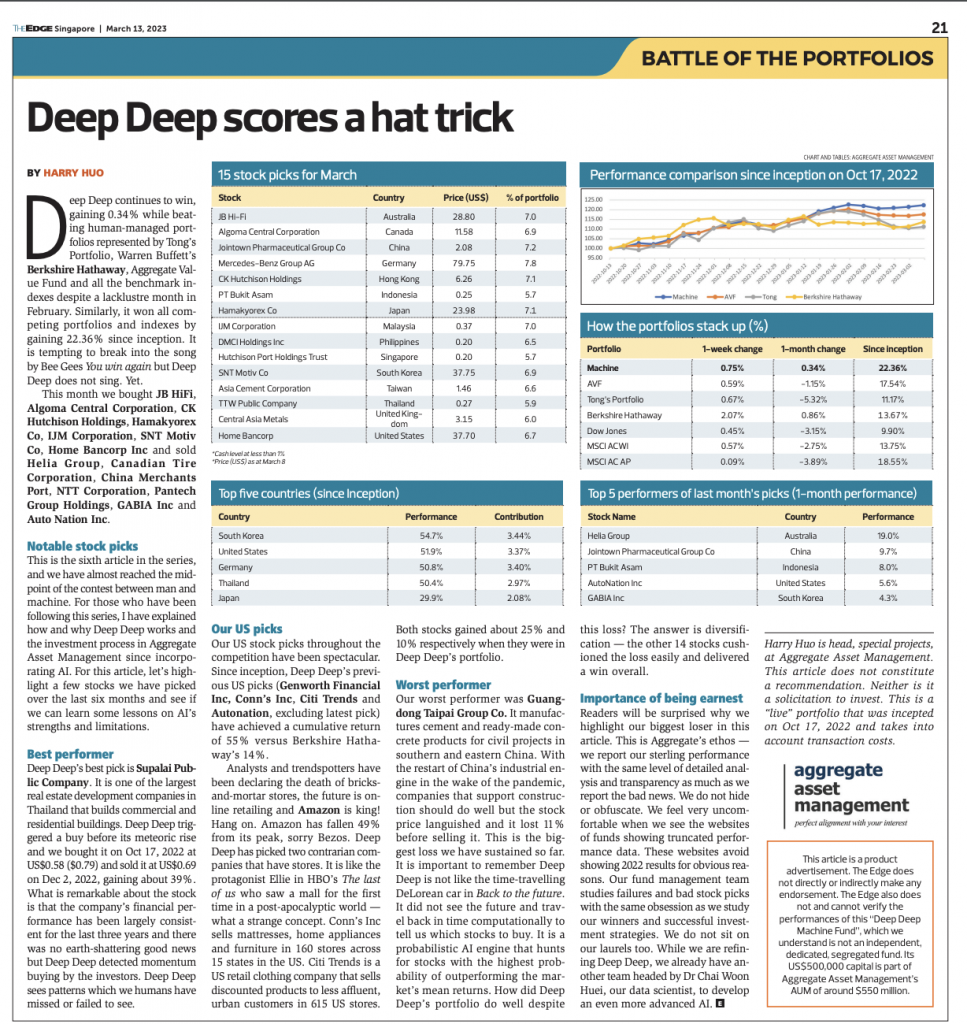

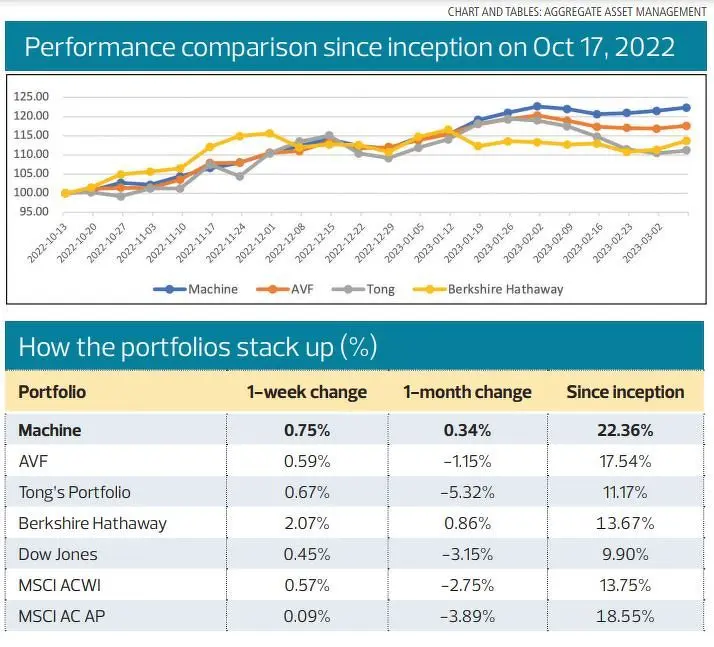

Deep Deep continues to win, gaining 0.34% while beating human-managed portfolios represented by Tong’s Portfolio, Warren Buffett’s Berkshire Hathaway, Aggregate Value Fund and all the benchmark indexes despite a lacklustre month in February. Similarly, it won all competing portfolios and indexes by gaining 22.36% since inception. It is tempting to break into the song by Bee Gees You win again but Deep Deep does not sing. Yet.

This month we bought JB HiFi, Algoma Central Corporation, CK Hutchison Holdings, Hamakyorex Co, IJM Corporation, SNT Motiv Co, Home Bancorp Inc and sold Helia Group, Canadian Tire Corporation, China Merchants Port, NTT Corporation, Pantech Group Holdings, GABIA Inc and Auto Nation Inc.

Notable stock picks

This is the sixth article in the series, and we have almost reached the midpoint of the contest between man and machine. For those who have been following this series, I have explained how and why Deep Deep works and the investment process in Aggregate Asset Management since incorporating AI. For this article, let’s highlight a few stocks we have picked over the last six months and see if we can learn some lessons on AI’s strengths and limitations.

Best performer

Deep Deep’s best pick is Supalai Public Company. It is one of the largest real estate development companies in Thailand that builds commercial and residential buildings. Deep Deep triggered a buy before its meteoric rise and we bought it on Oct 17, 2022 at US$0.58 ($0.79) and sold it at US$0.69 on Dec 2, 2022, gaining about 39%. What is remarkable about the stock is that the company’s financial performance has been largely consistent for the last three years and there was no earth-shattering good news but Deep Deep detected momentum buying by the investors. Deep Deep sees patterns which we humans have missed or failed to see.

Our US picks

Our US stock picks throughout the competition have been spectacular. Since inception, Deep Deep’s previous US picks (Genworth Financial Inc, Conn’s Inc, Citi Trends and Autonation, excluding latest pick) have achieved a cumulative return of 55% versus Berkshire Hathaway’s 14%.

Analysts and trendspotters have been declaring the death of brick-and-mortar stores, the future is online retailing and Amazon is king! Hang on. Amazon has fallen 49% from its peak, sorry Bezos.

Deep Deep has picked two contrarian companies that have stores. It is like the protagonist Ellie in HBO’s The last of us who saw a mall for the first time in a post-apocalyptic world — what a strange concept. Conn’s Inc sells mattresses, home appliances and furniture in 160 stores across 15 states in the US. Citi Trends is a US retail clothing company that sells discounted products to less affluent, urban customers in 615 US stores. Both stocks gained about 25% and 10% respectively when they were in Deep Deep’s portfolio.

Warren Buffett is very fond of telling the famous story of how he discovered Rose Blumkin of Nebraska Furniture Mart and bought the company with a one-page handshake deal.

Today, we have the 2022–23 story of how Deep Deep discovered Conn’s Inc and Citi Trends at light speed. Buffett, please note that Deep Deep did not even visit the stores.

Worst performer

Our worst performer was Guangdong Taipai Group Co. It manufactures cement and ready-made concrete products for civil projects in southern and eastern China. With the restart of China’s industrial engine in the wake of the pandemic, companies that support construction should do well but the stock price languished and it lost 11% before selling it. This is the biggest loss we have sustained so far. It is important to remember Deep Deep is not like the time-travelling DeLorean car in Back to the future. It did not see the future and travel back in time computationally to tell us which stocks to buy. It is a probabilistic AI engine that hunts for stocks with the highest probability of outperforming the market’s mean returns. How did Deep Deep’s portfolio do well despite this loss? The answer is diversification — the other 14 stocks cushioned the loss easily and delivered a win overall.

Importance of being earnest

Readers will be surprised why we highlight our biggest loser in this article. This is Aggregate’s ethos — we report our sterling performance with the same level of detailed analysis and transparency as much as we report the bad news. We do not hide or obfuscate. “This is the way” as Star Wars’ The Mandalorian would have said. We feel very uncomfortable when we see the websites of funds showing truncated performance data. These websites avoid showing 2022 results for obvious reasons. Our fund management team studies failures and bad stock picks with the same obsession as we study our winners and successful investment strategies. Having an ego is almost a crime in Aggregate. We do not sit on our laurels too. While we are refining Deep Deep, we already have another team headed by Dr Chai Woon Huei, our data scientist, to develop an even more advanced AI. “It is miles to go before we sleep,” says Robert Frost. But our team can never sleep so that Deep Deep can continue to win it all.

Harry Huo is head, special projects, at Aggregate Asset Management. This article does not constitute a recommendation. Neither is it a solicitation to invest. This is a “live” portfolio that was incepted on Oct 17, 2022 and takes into account transaction costs.

To view all articles in the Man vs Machine Challenge series, please click here.

This article was published on The Edge Singapore on 09 March, 2023.