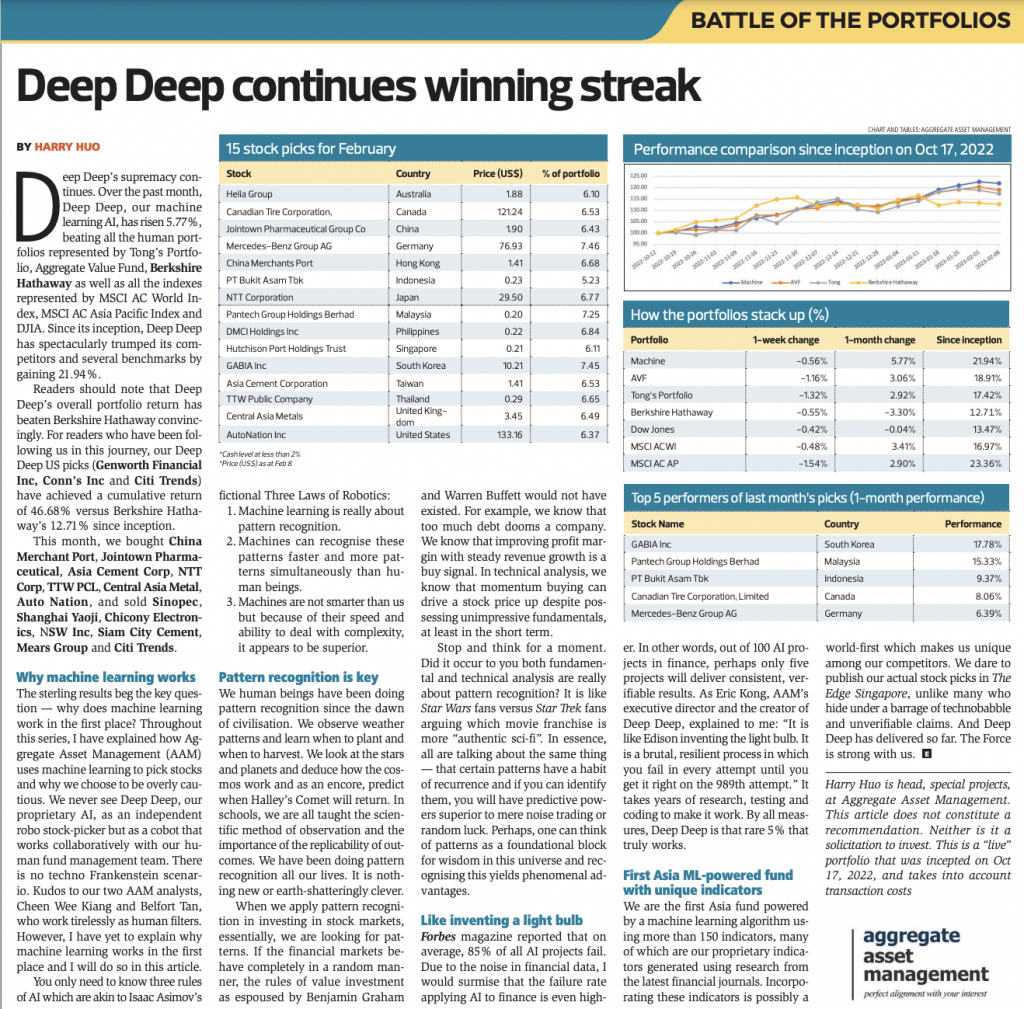

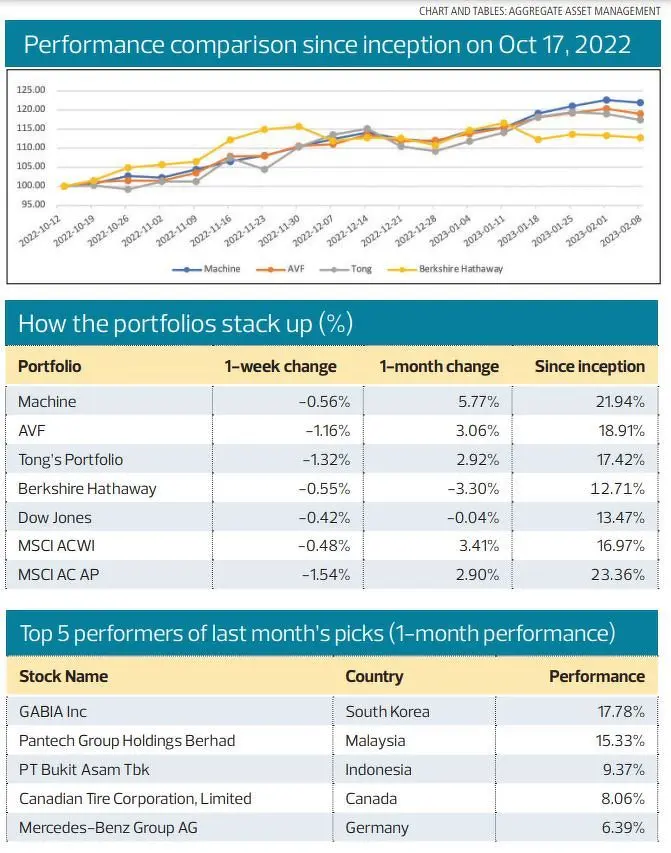

Deep Deep’s supremacy continues. Over the past month, Deep Deep, our machine learning AI, has risen 5.77%, beating all the human portfolios represented by Tong’s Portfolio, Aggregate Value Fund, Berkshire Hathaway as well as all the indexes represented by MSCI AC World Index, MSCI AC Asia Pacific Index and DJIA. Since its inception, Deep Deep has spectacularly trumped its competitors and several benchmarks by gaining 21.94%.

Readers should note that Deep Deep’s overall portfolio return has beaten Berkshire Hathaway convincingly. For readers who have been following us in this journey, our Deep Deep US picks (Genworth Financial Inc, Conn’s Inc and Citi Trends) have achieved a cumulative return of 46.68% versus Berkshire Hathaway’s 12.71% since inception. This month, we bought China Merchant Port, Jointown Pharmaceutical, Asia Cement Corp, NTT Corp, TTW PCL, Central Asia Metal, Auto Nation, and sold Sinopec, Shanghai Yaoji, Chicony Electronics, NSW Inc, Siam City Cement, Mears Group and Citi Trends.

Why machine learning works

The sterling results beg the key question — why does machine learning work in the first place? Throughout this series, I have explained how Aggregate Asset Management (AAM) uses machine learning to pick stocks and why we choose to be overly cautious. We never see Deep Deep, our proprietary AI, as an independent robo stock-picker but as a cobot that works collaboratively with our human fund management team. There is no techno Frankenstein scenario. Kudos to our two AAM analysts, Cheen Wee Kiang and Belfort Tan, who work tirelessly as human filters. However, I have yet to explain why machine learning works in the first place and I will do so in this article.

You only need to know three rules of AI which are akin to Isaac Asimov’s fictional Three Laws of Robotics:

1. Machine learning is really about pattern recognition.

2. Machines can recognise these patterns faster and more patterns simultaneously than human beings.

3. Machines are not smarter than us but because of their speed and ability to deal with complexity, it appears to be superior.

Pattern recognition is key

We human beings have been doing pattern recognition since the dawn of civilisation. We observe weather patterns and learn when to plant and when to harvest. We look at the stars and planets and deduce how the cosmos work and as an encore, predict when Halley’s Comet will return. In schools, we are all taught the scientific method of observation and the importance of the replicability of outcomes. We have been doing pattern recognition all our lives. It is nothing new or earth-shatteringly clever.

When we apply pattern recognition in investing in stock markets, essentially, we are looking for patterns. If the financial markets behave completely in a random manner, the rules of value investing as espoused by Benjamin Graham and Warren Buffett would not have existed. For example, we know that too much debt dooms a company. We know that improving profit margin with steady revenue growth is a buy signal. In technical analysis, we know that momentum buying can drive a stock price up despite possessing unimpressive fundamentals, at least in the short term.

Stop and think for a moment. Did it occur to you both fundamental and technical analysis is really about pattern recognition? It is like Star Wars fans versus Star Trek fans arguing which movie franchise is more “authentic sci-fi”. In essence, all are talking about the same thing — that certain patterns have a habit of recurrence and if you can identify them, you will have predictive powers superior to mere noise trading or random luck. Perhaps, one can think of patterns as a foundational block for wisdom in this universe and recognising this yields phenomenal advantages.

Like inventing the light bulb

Forbes magazine reported that on average, 85% of all AI projects fail. Due to the noise in financial data, I would surmise that the failure rate applying AI to finance is even higher. In other words, out of 100 AI projects in finance, perhaps only five projects will deliver consistent, verifiable results. As Eric Kong, AAM’s executive director and the creator of Deep Deep, explained to me: “It is like Edison inventing the light bulb. It is a brutal, resilient process in which you fail in every attempt until you get it right on the 989th attempt.” It takes years of research, testing and coding to make it work. By all measures, Deep Deep is that rare 5% that truly works.

First Asia ML-powered fund with unique indicators

We are the first Asia fund powered by a machine learning algorithm using more than 150 indicators, many of which are our proprietary indicators generated using research from the latest financial journals. Incorporating these indicators is possibly a world-first which makes us unique among our competitors. We dare to publish our actual stock picks in The Edge Singapore, unlike many who hide under a barrage of technobabble and unverifiable claims. And Deep Deep has delivered so far. The Force is strong with us.

Harry Huo is head, special projects, at Aggregate Asset Management. This article does not constitute a recommendation. Neither is it a solicitation to invest. This is a “live” portfolio that was incepted on Oct 17, 2022, and takes into account transaction costs.

To view all articles in the Man vs Machine Challenge series, please click here.

This article was published on The Edge Singapore on 09 February, 2023.