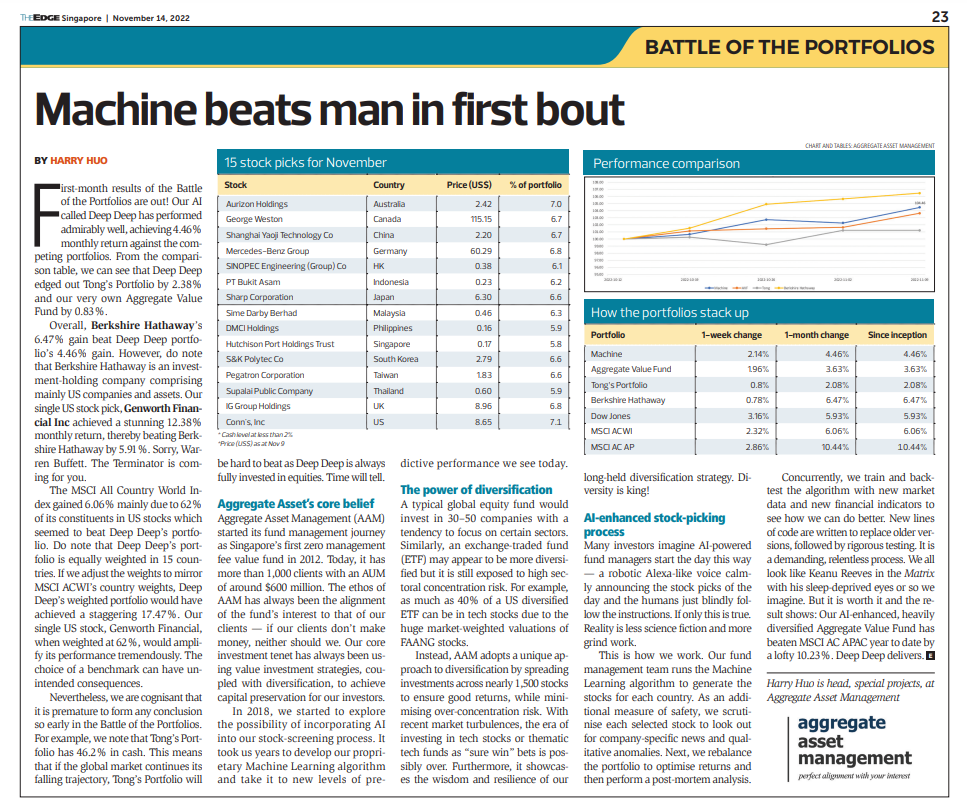

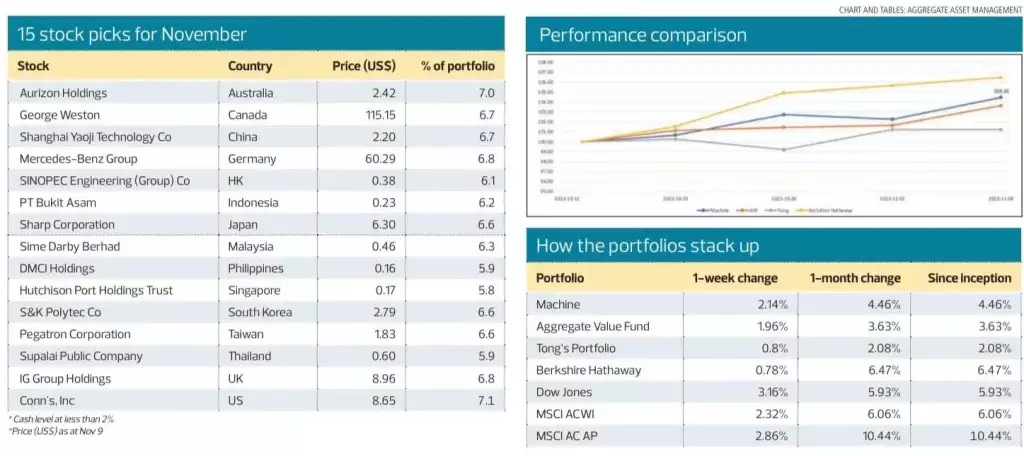

First-month results of the Battle of the Portfolios are out! Our AI called Deep Deep has performed admirably well, achieving 4.46% monthly return against the competing portfolios. From the comparison table, we can see that Deep Deep edged out Tong’s Portfolio by 2.38% and our very own Aggregate Value Fund by 0.83%.

Overall, Berkshire Hathaway’s 6.47% gain beat Deep Deep portfolio’s 4.46% gain. However, do note that Berkshire Hathaway is an investment-holding company comprising mainly US companies and assets. Our single US stock pick, Genworth Financial Inc achieved a stunning 12.38% monthly return, thereby beating Berkshire Hathaway by 5.91%. Sorry, Warren Buffett. The Terminator is coming for you.

The MSCI All Country World Index gained 6.06% mainly due to 62% of its constituents in US stocks which seemed to beat Deep Deep’s portfolio. Do note that Deep Deep’s portfolio is equally weighted in 15 countries. If we adjust the weights to mirror MSCI ACWI’s country weights, Deep Deep’s weighted portfolio would have achieved a staggering 17.47%. Our single US stock, Genworth Financial, when weighted at 62%, would amplify its performance tremendously. The choice of a benchmark can have unintended consequences.

Nevertheless, we are cognisant that it is premature to form any conclusion so early in the Battle of the Portfolios. For example, we note that Tong’s Portfolio has 46.2% in cash. This means that if the global market continues its falling trajectory, Tong’s Portfolio will be hard to beat as Deep Deep is always fully invested in equities. Time will tell.

Aggregate Asset’s Core Belief

Aggregate Asset Management (AAM) started its fund management journey as Singapore’s first zero management fee value fund in 2012. Today, it has more than 1,000 clients with an AUM of around $600 million. The ethos of AAM has always been the alignment of the fund’s interest to that of our clients — if our clients don’t make money, neither should we. Our core investment tenet has always been using value investment strategies, coupled with diversification, to achieve capital preservation for our investors.

In 2018, we started to explore the possibility of incorporating AI into our stock-screening process. It took us years to develop our proprietary Machine Learning algorithm and take it to new levels of predictive performance we see today.

The Power of Diversification

A typical global equity fund would invest in 30–50 companies with a tendency to focus on certain sectors. Similarly, an exchange-traded fund (ETF) may appear to be more diversified but it is still exposed to high sectoral concentration risk. For example, as much as 40% of a US diversified ETF can be in tech stocks due to the huge market-weighted valuations of FAANG stocks.

Instead, AAM adopts a unique approach to diversification by spreading investments across nearly 1,500 stocks to ensure good returns, while minimising over-concentration risk. With recent market turbulences, the era of investing in tech stocks or thematic tech funds as “sure win” bets is possibly over. Furthermore, it showcases the wisdom and resilience of our long-held diversification strategy. Diversity is king!

AI-enhanced Stock-picking Process

Many investors imagine AI-powered fund managers start the day this way — a robotic Alexa-like voice calmly announcing the stock picks of the day and the humans just blindly follow the instructions. If only this is true. Reality is less science fiction and more grind work.

This is how we work. Our fund management team runs the Machine Learning algorithm to generate the stocks for each country. As an additional measure of safety, we scrutinise each selected stock to look out for company-specific news and qualitative anomalies. Next, we rebalance the portfolio to optimise returns and then perform a post-mortem analysis.

Concurrently, we train and backtest the algorithm with new market data and new financial indicators to see how we can do better. New lines of code are written to replace older versions, followed by rigorous testing. It is a demanding, relentless process. We all look like Keanu Reeves in the Matrix with his sleep-deprived eyes or so we imagine. But it is worth it and the result shows: Our AI-enhanced, heavily diversified Aggregate Value Fund has beaten MSCI AC APAC year to date by a lofty 10.23%. Deep Deep delivers.

To view all articles in the Man vs Machine Challenge series, please click here.

This article was first published on The Edge Singapore on 10 Nov, 2022