Man vs Machine Challenge

Hollywood depictions of artificial intelligence or AI have often painted a bleak picture of humanity. From the murderous Hal-9000 in Space Odyssey 2001 to the genocidal Skynet in the Terminator series, AI is a bad boy.

A more down-to-earth example is the documentary AlphaGo in which an over-confident South Korean GO Master turned pale white when he was pitted against a neural network-trained AI by Google.

He soon realised that not only would he lose badly but that no human challenger will ever win again. However, we can take comfort that humans fare much better in less structured decision-making situations. For example, in deciding the value of a piece of art or evaluating a manager’s performance, humans have not lost all the battles yet.

What about fund management? Can machine beat man in managing a stock portfolio? Data scientists have often labelled financial data as “noisy” because it is extremely hard to find a correlation between stock performance and a data set — be it price data, financial ratios or stock market news. There are simply too many reasons why a stock price will go up or down.

It is with such a fascinating backdrop that I joined Aggregate Asset Management (AAM). Eric Kong, co-founder and fund manager of AAM, convinced me that he has been perfecting his stock selection process using machine learning (AI) for the last four years and has delivered some very credible results.

AAM is a zero-management fees, globally diversified fund management company and its foundational belief is that a cash-weighted, highly diversified global portfolio is the best way for capital preservation for our high-net-worth clients. Presently, we use AI as a stock screener to add value to our decision-making process. AI is a mere tool to improve our stock-picking abilities.

Kevin Tok, our co-founder and executive director, posed this challenge to us: Can AI beat human fund managers and analysts in stock selection? It begs the next question: Can an all-powerful AI picking just 15 stocks per month beat a highly diversified global portfolio using both AI and human inputs? The proxy for this would be Aggregate’s own Aggregate Value Fund (AVF). Kong coined this contest “Machine versus Human”. I share both the founders’ innate curiosity and the result is this new column for The Edge Singapore. It will be a fun and exciting “thought experiment” as physicist Albert Einstein was fond of saying.

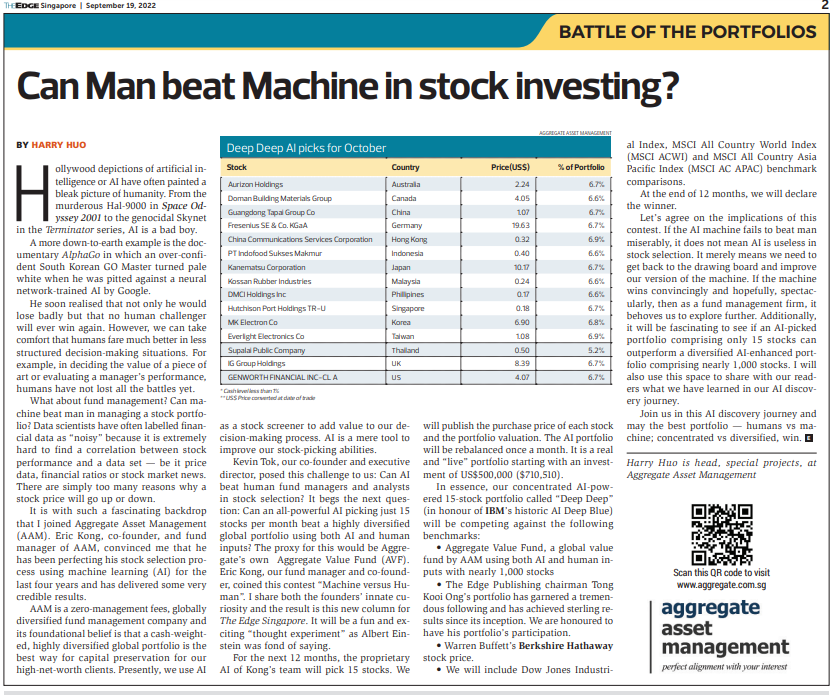

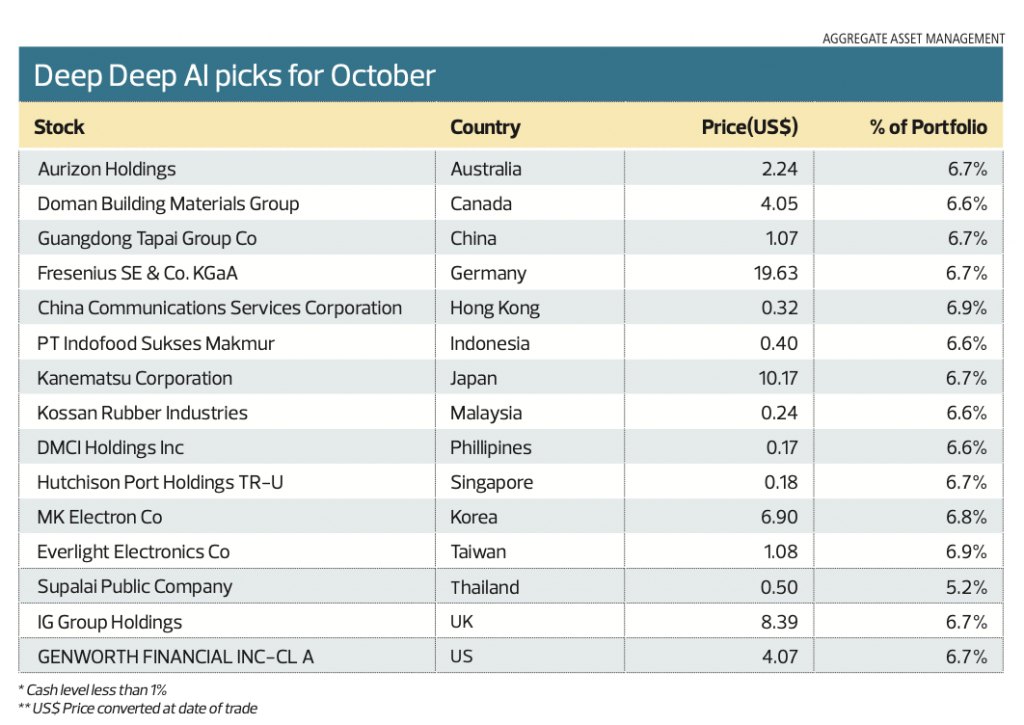

For the next 12 months, the proprietary AI of Kong’s team will pick 15 stocks. We will publish the purchase price of each stock and the portfolio valuation. The AI portfolio will be rebalanced once a month. It is a real and “live” portfolio starting with an investment of US$500,000 ($710,510).

In essence, our concentrated AI-powered 15-stock portfolio called “Deep Deep” (in honour of IBM’s historic AI Deep Blue) will be competing against the following benchmarks:

- Aggregate Value Fund, a global value fund by AAM using both AI and human inputs with nearly 1,000 stocks

- The Edge Publishing chairman Tong Kooi Ong’s portfolio has garnered a tremendous following and has achieved sterling results since its inception. We are honoured to have his portfolio’s participation.

- Warren Buffett’s Berkshire Hathaway stock price.

- We will include Dow Jones Industrial Index, MSCI All Country World Index (MSCI ACWI) and MSCI All Country Asia Pacific Index (MSCI AC APAC) benchmark comparisons.

At the end of 12 months, we will declare the winner.

Let us agree on the implications of this contest. If the AI machine fails to beat man miserably, it does not mean AI is useless in stock selection. It merely means we need to get back to the drawing board and improve our version of the machine. If the machine wins convincingly and hopefully, spectacularly, then as a fund management firm, it behoves us to explore further. Additionally, it will be fascinating to see if an AI-picked portfolio comprising only 15 stocks can outperform a diversified AI-enhanced portfolio comprising nearly 1,000 stocks. I will also use this space to share with our readers what we have learned in our AI discovery journey.

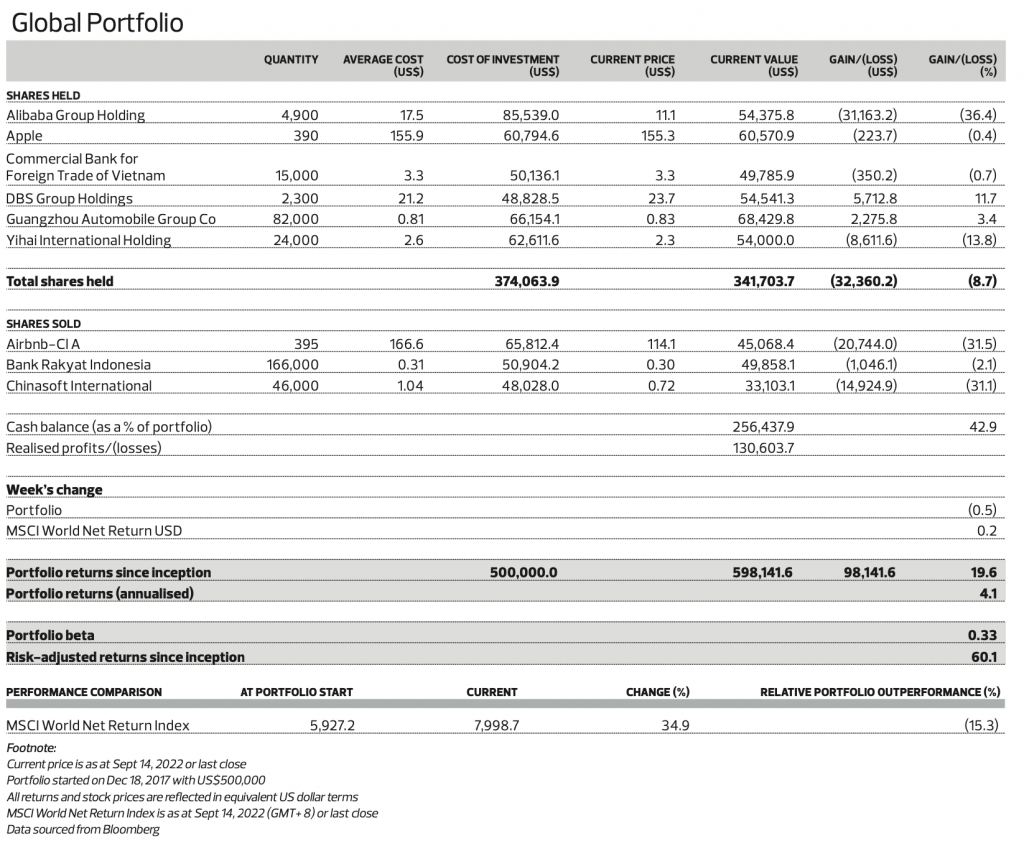

Tong’s Portfolio

Deep Deep AI Picks

The table above shows the 15 stocks picked on Oct 17 by Aggregate Asset Management to form a concentrated, proprietary AI-picked portfolio. This machine-picked portfolio will challenge human stock pickers via the following competing portfolios and benchmarks:

a. Aggregate Asset Management’s diversified fund, Aggregate Value Fund, with nearly 1,000 stocks picked by human inputs but enhanced by AI stock screening.

b. Tong’s Portfolio which has been published in The Edge Singapore since December 2017.

c. Warren Buffett’s investment vehicle Berkshire Hathaway’s stock performance.

d. Dow Jones Industrial Index, MSCI All Country World Index (MSCI ACWI) and MSCI AC Asia Pacific (MSCI AC APAC) will be included as reference benchmarks.

Next month onwards, we will publish an updated table showing the relative performance of these portfolios and benchmarks, and we will continue to do so monthly for a year. In October 2023, we will declare the winning portfolio based on the highest portfolio return. For simplicity, all our portfolios’ returns and benchmarks will be in US dollar for easy comparison.

Join us in this AI discovery journey and may the best portfolio — man vs machine; concentrated vs diversified, win.

To view all articles in the Man vs Machine Challenge series, please click here.

This article was published on The Edge Singapore on 19 SEPTEMBER , 2022.